One of the biggest questions bankruptcy filers have is what they can keep throughout the process — especially their house and car. Exactly what assets you can retain largely depends on whether you are filing Chapter 7 or Chapter 13 bankruptcy and whether your property is classified as “exempt” or “nonexempt.”

Exempt means you may retain the asset (or its value), whereas nonexempt describes property you must surrender to your bankruptcy case trustee — the person who administers your case. Read on to learn what you can and cannot keep in bankruptcy, how auto and homestead exemptions work, and whether federal or state exemption laws apply to your case.

How Bankruptcy Exemptions Work

Exemptions can be somewhat complicated. For this reason, we strongly recommend that you hire a bankruptcy attorney to ensure you are correctly following the appropriate exemption rules (see "Bankruptcy Exemption Laws" section).

Depending on the applicable exemption, either the full value of your asset or a certain amount of its monetary value will be protected and not subject to liquidation by your case trustee.

Chapter 7 Bankruptcy Exemptions

Any property that you can fully exempt in Chapter 7 bankruptcy will be immune to liquidation. Nonexempt property, on the other hand, will be sold by your case trustee to pay off your unsecured debts. This is the price you pay to have a certain amount of what you owe discharged. However, not all of your nonexempt assets will be sold for cash, and you may be able to keep certain items even if you cannot fully exempt them.

Chapter 13 Bankruptcy Exemptions

Chapter 13 bankruptcy does not involve liquidation and generally enables you to keep all of your assets, even those that are technically nonexempt. The reason exempt and nonexempt assets are important to Chapter 13 is that the value of your exempt assets is directly commensurate with your Chapter 13 payments. The more you can exempt, the lower your plan payments will be.

Although nonexempt assets won’t be handed over to your trustee for sale to pay off your debts, their value must be paid toward your “nonpriority unsecured debts” (e.g., credit cards, medical bills). In other words, you can keep your stuff. But because these items technically contribute to your net worth, your ability to pay off debts is considered based on the value of these belongings.

What You Can & Cannot Keep in Bankruptcy

As mentioned earlier, whether or not you can retain an asset depends on the bankruptcy chapter you file as well as both state and federal exemption rules. Below are the most common exempt and nonexempt assets in a personal bankruptcy case.

| Assets That Are Typically Exempt (NOT Liquidated): | ||

| Primary Automobile* | Primary Home** | IRAs and Other Retirement Assets |

| Household Items (e.g., clothing, furnishings, appliances) | Prescribed Health Aids/ Medical Supplies | Jewelry (up to a certain value) |

| Social Security Benefits | Welfare Benefits | Unemployment Benefits |

| Disability Benefits | Veteran's Benefits | Child Support/Alimony/Maintenance |

| Percentage of Your Unpaid Earned Wages | Damages Awarded for Personal Injury | Work Tools |

*Depending on whether you owe money on the vehicle, can afford to keep it and can apply an exemption to it.

**Depending on whether you are current on your mortgage and how much equity you have and can exempt in the property.

| Assets That Are Typically Nonexempt (Liquidated): | ||

| Second Automobile | Second or Vacation Home | Cash/Bank Accounts/Investments |

| Family Heirlooms | Expensive Musical Instruments (unless you’re a musician by trade) | Valuable Collections (e.g., stamps, coins) |

| Entertainment Equipment (e.g., TV, radio) Exceeding a Certain Value | Works of Art (unless created by you or a relative) | Jewelry (except your wedding ring) Exceeding a Certain Value |

Your Car & House in Bankruptcy

With respect to your primary vehicle and primary home (most debtors’ principal concerns), you can generally retain the property if you meet one of the following conditions. Keep in mind that just because you are able to retain property does not mean you are free from satisfying your obligation to repay remaining amounts owed.

1) You Lack Equity — That is, you owe more on your auto or mortgage loan than your car or home is worth.

2) You’re Filing Chapter 13 — You must be current on your auto or mortgage loan in order to keep your car or home. If you've fallen behind on payments, Chapter 13 will allow you to make up missed payments over the three- to five-year repayment period. You cannot do so in Chapter 7.

3) You’re Filing Chapter 7 and Meet ALL of the Following Conditions:

- You Have Equity: The value of your property is greater than the outstanding balance on the loan securing it.

- You Can Exempt Your Equity: Your equity in the property must be fully covered by the exemption and, in most cases, must not exceed the exemption limit allowed by law. You can read about Exempt and Nonexempt Assets above. One exception to this is when the potential profit from a sale would not sufficiently benefit your creditors, in which case your trustee may “abandon” (or let you keep) the property. You should also ask your bankruptcy attorney about other options such as reaffirming your debt or converting your Chapter 7 case to a Chapter 13.

- You’re Current on Payments: You must be in good standing with your creditor/lender in order to qualify for an exemption. As a result, you may want to make up some missed minimum payments in preparation for bankruptcy.

To illustrate how auto and homestead exemptions apply in a Chapter 7 case, consider the following examples. The matrix below also summarizes the steps involved in determining whether you can keep or must surrender your car or house.

Auto Exemption:

Let’s say you own a car worth $6,000 and owe $5,000 on your auto loan. Subtract your debt ($5,000) from the car’s replacement value ($6,000), and the difference is your equity ($1,000).

If your state’s auto exemption is, say, $1,500, you can exempt all of your equity. As long as you continue to make timely auto payments, you can keep the vehicle.

If, however, your state’s auto exemption is only $200, your trustee will likely sell your car to pay your creditors. Your trustee will then pay you the exempt amount of $200 and pay the remaining $1,300 to your creditors after subtracting any expenses related to the sale.

Homestead Exemption:

Suppose you own a house worth $150,000 and owe $100,000 on your mortgage loan. Subtract your debt ($100,000) from the home’s value ($150,000), and the difference is your equity ($50,000). If your state’s homestead exemption is, say, $50,000, you can exempt all of your equity. As long as you continue to make timely mortgage payments, you can keep your house.

If, however, your state’s homestead exemption is only $35,000, your trustee will likely sell your house. Your trustee will then pay you the exempt amount, which is $35,000 (following the above example), and use the remaining $15,000 to pay for costs associated with the sale and to pay your creditors.

No-Asset Bankruptcy Cases

Chapter 7 bankruptcy cases generally avoid the complications of evaluating what is exempt because most are “no-asset” cases, which means debtors do not have any nonexempt property that can be sold to pay their creditors. In other words, debtors in these cases may keep all of their assets.

It is common for all of a debtor’s assets to be exempt for the following reasons:

- The exemption system is designed to allow debtors to keep property needed for everyday living.

- Household goods and furnishings quickly diminish in resale value and are thus typically not worth liquidating.

- IRAs and other retirement savings are generally exempt.

Bankruptcy Exemption Laws

State vs. Federal Exemptions

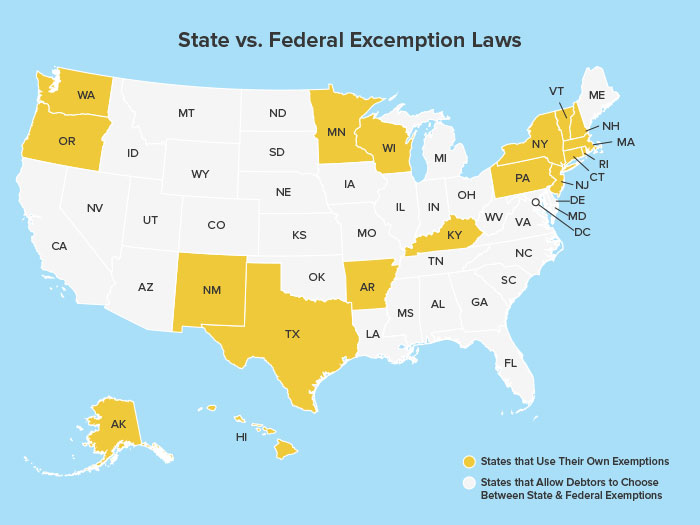

Exemption rules are typically defined at the state level. All debtors must use their state’s exemption laws unless they live in one of the states that allow debtors to choose between federal and state exemption laws.

The map below will help you determine which laws apply to you. In general, you can use a state’s laws if you’ve lived permanently in that state for at least two years prior to filing for bankruptcy. If you have moved in the last two years, however, the rules can be a bit more complicated. Ask your bankruptcy attorney about “domicile requirements,” or residency rules that dictate which exemption laws you must use.

Federal Nonbankruptcy Exemptions

In addition to federal bankruptcy exemptions, federal nonbankruptcy exemptions (the name is confusing, we know) also exist to help you keep certain assets, such as retirement and disability benefits. If you are using your state’s exemption laws, you’re free to combine federal nonbankruptcy exemptions with your state’s exemptions. You cannot do so if you choose the federal exemption laws.

In order to use these exemptions, you must also be a member of a certain industry, group or organization or receive certain benefits. For further guidance on eligibility, consult your bankruptcy attorney.

Wildcard Exemption

In many states, a “wildcard” exemption of a given amount can be applied toward any personal property, even real estate in some cases. You can use it either to exempt property that would otherwise be nonexempt or to boost the amount of an existing exemption. The wildcards exist to prevent liquidation of valuable assets to collect small amounts of money.

For instance, if your state’s auto exemption limit is $3,000 and your auto equity is $3,500, you can use a wildcard exemption of $500 to cover the difference and save your property from liquidation. Wildcard exemption amounts also vary by state.

Tips for Maximizing Bankruptcy Exemptions

Although most Chapter 7 cases are “no-asset” cases and Chapter 13 debtors get to keep all of their property, it’s important to understand how you can maximize the value of your exemptions. Keep in mind that the more property you can exempt, the less you’ll have to part with in Chapter 7 and the lower your Chapter 13 payments will be. Follow the advice below to learn how to keep as much property and money as possible in bankruptcy:

- Hire a Good Attorney: Bankruptcy exemptions are complex. An experienced bankruptcy attorney can help you identify the appropriate exemptions and how to keep the most property. Before you file for bankruptcy, we suggest meeting with at least three attorneys and asking about each one’s track record and legal fees. Also ask for references. WalletHub’s bankruptcy attorney comparison tool can help you find the best bankruptcy attorneys in your area.

- Choose Your Exemptions Wisely: If your state allows you to choose between state and federal exemption laws, make sure to determine which set would allow you to exempt the most assets. Keep in mind that you can only choose between the state and federal systems, not combine exemptions from each. If you ultimately select the state option, ask your attorney if you qualify for federal nonbankruptcy exemptions and whether wildcard exemptions are available in your state. And, if you moved recently, see if you have the option to use your previous state’s exemption laws.

- Convert Exemption Value: A good attorney can provide guidance on maximizing your exemptions by converting some nonexempt value into exempt value. For instance, you can buy some necessary household items (e.g., food, clothing) with the cash in your bank account, which would otherwise be liquidated. This is permissible so long as the conversion amount is “reasonable,” the definition of which varies broadly by each bankruptcy court.

- Hold Off on Filing If You Can: If you anticipate receiving money from, say, a tax refund or an inheritance, consider delaying your filing. These funds become property of the estate in bankruptcy, which means you’ll need to surrender them once your case is opened. If you decide to put off filing until after you’ve received the funds and used them up, be careful about what you spend your money on. If you buy nonexempt property, that will ultimately be liquidated — thus defeating the purpose of the delay.

Fact Checked By

Mike Hanrahan

Mike is an attorney at Chase & Bylenga, PLLC with a focus on bankruptcy, taxation and business. He earned his JD from Thomas Cooley Law School and a Master's of Laws in Taxation from Western Michigan University.

WalletHub experts are widely quoted. Contact our media team to schedule an interview.