- Best gas credit cards compared

- Methodology

- Sources

- 4 Tips for Picking the Best Gas Rewards Card

- About the author

- User questions & answers

- Expert opinions

Best Gas Credit Cards Compared

| Credit Card | Category | Gas Rewards |

| Citi Custom Cash® Card | Best Overall | Up to 5% Cash Back |

| HSBC Premier World Credit Card | Best for Initial Bonus | 5% |

| Citi Strata Premier® Card | Best for Bonus Rewards | 3 points / $1 |

| Upgrade Cash Rewards Visa® | Best for Fair Credit | 1.5% Cash Back |

| Bank of America® Customized Cash Rewards Secured Credit Card | Best for Rebuilding Credit | 6% Cash Back |

| U.S. Bank Business Altitude® Connect Visa Signature® Card | Best for Small Business | 4 points / $1 |

You need good or excellent credit to get the best of the best gas rewards cards. So if you don’t know how your score is doing these days, you can check it for free on WalletHub. We also recommend checking out the top cash back credit cards, which can save you a lot on gas and everything else.

Methodology for Selecting the Best Gas Credit Cards

To be eligible for consideration for WalletHub's best credit cards for gas, a card’s gas rewards must be at least 20% better than average. We base our calculations on two different consumer profiles. The first reflects the average American’s gas spending, while the second assumes three-times as much spent on gas. In both cases, we assume that someone looking for one of the best gas credit cards will employ the Island Approach, using the card only for gas purchases. That enables us to identify the credit cards with the best rewards on gas in particular, without earning rates for other spending categories distorting the rankings. Bonuses are considered if gas spending alone would put the cardholder within 10% of the spending threshold required to earn the bonus.

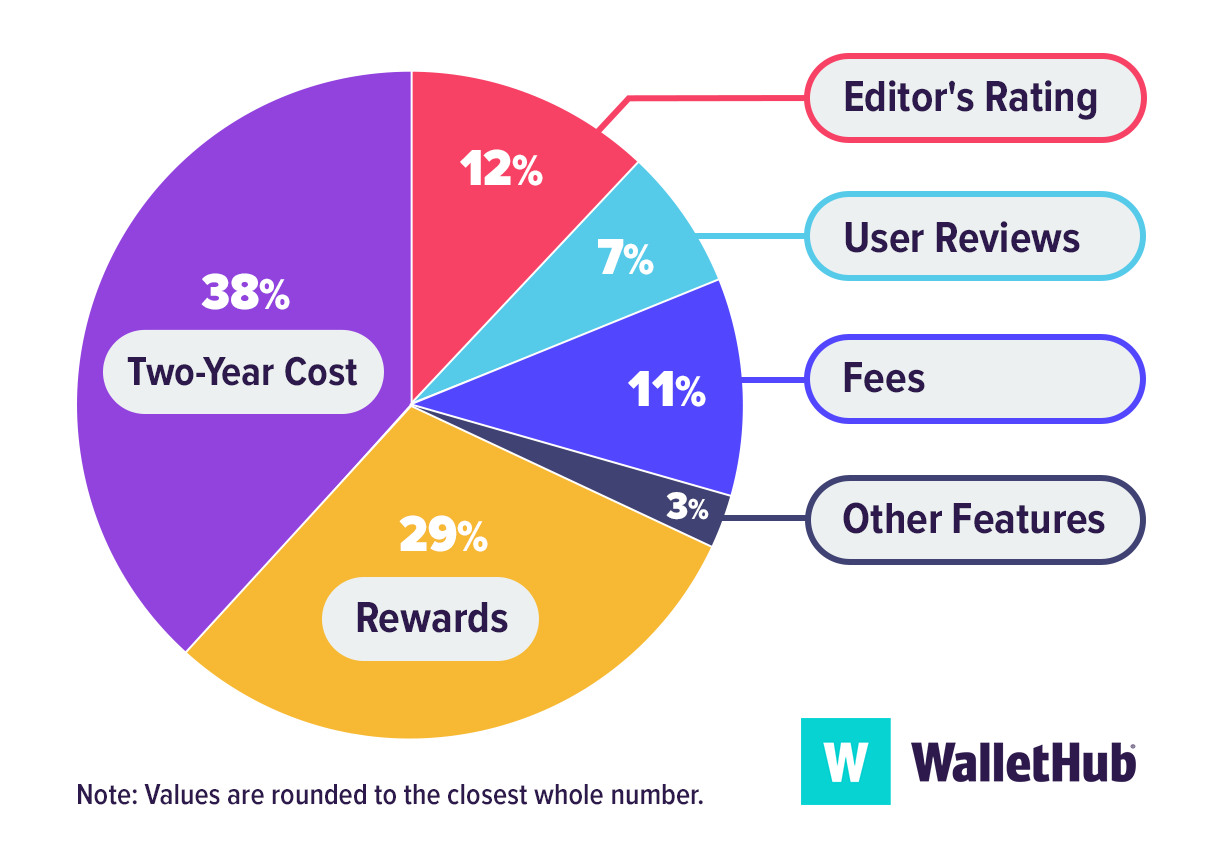

WalletHub's Key Rating Components

Two-Year Cost: 38% – We estimate the net cost or savings for the average cardholder over a two-year period by accounting for annual fees, rewards earned on gas and other purchases, and any ongoing credits or discounts. A negative result indicates overall savings.

Two-Year Cost: 38% – We estimate the net cost or savings for the average cardholder over a two-year period by accounting for annual fees, rewards earned on gas and other purchases, and any ongoing credits or discounts. A negative result indicates overall savings.

Rewards: 29% – We analyze how much value each card returns on gas spending and other everyday purchases, how flexible the rewards are, and how easily they can be redeemed for cash back, statement credits, or other options.

Editor’s Rating: 12% – WalletHub editors score each gas credit card based on its reward rates, fee structure, and overall usefulness compared to similar cards.

Fees: 11% – We consider all fees associated with each card, including annual fees and transaction-related charges that may affect everyday use.

User Reviews: 7% – We use consumer feedback to assess satisfaction with the card’s rewards, costs, and ease of use.

Other Features: 3% – We evaluate gas-specific extras such as acceptance at major gas station chains, discounts at select fuel brands, bonus rewards at partner locations, and tools that help cardholders track fuel spending or locate participating gas stations.

To ensure broader coverage, the list includes cards designed for distinct audiences, resulting in variations in scoring. For example, cards aimed at consumers with low credit scores are scored slightly differently.

Sources

WalletHub actively maintains a database of 1,500+ credit card offers, from which we select the best gas credit cards for different applicants as well as derive market-wide takeaways and trends. The underlying data is compiled from credit card company websites or provided directly by the credit card issuers. We also leverage data from the Bureau of Labor Statistics to develop cardholder profiles, used to estimate cards’ potential savings.

4 Tips for Picking the Best Gas Rewards Card

-

Avoid Station-Specific Cards if You Can’t Commit

Station-affiliated gas credit cards have the potential to offer the most lucrative rewards, but they certainly aren’t for everyone. You’ll only get rewarded for gas purchased at affiliated stations, and in many cases, you’ll have to spend a lot just to qualify for the highest earning rates.

So you should only get a gas credit card that’s tied to a specific station if you already fill up at just one chain or could easily do so. After all, there are plenty of general-purpose credit cards offering great gas rewards. -

Decide How Many Credit Cards You Want to Use

Do you want a card with gas rewards to use just for gas purchases or for all of your everyday spending? Answering this question will tell you whether to focus solely on a card’s gas rewards or consider its complete rewards package. As a result, it will dictate how you should compare gas credit cards.

You can check out our article on the Island Approach to learn how to most effectively use multiple cards. -

Check the Gas-Price Forecast

Some gas rewards cards offer a certain number of points per $1 spent. Others give you a per-gallon discount or a percentage of your overall purchase in cash back. Converting everything into dollar terms based on the price of gas at the station you use is the best way to compare offers. You should also consider how attractive a given card’s terms will be if the price of gas rises. -

Save with a Big Initial Bonus

It’s easy to get so caught up in getting the best gas credit card that you neglect to consider other savings possibilities. For example, the best credit card deals offer people with good or excellent credit initial bonuses worth $400+ for spending $3,000+ within three months of account opening. Even the best gas credit cards require you to spend far more to earn $400 in rewards.