A collection account is a debt that has gone unpaid for so long that the original lender sells it to a debt collector, giving the agency the right to pursue payment. Having a collection account on your credit report significantly harms your credit score (which is likely already low due to missed payments), and it remains on your report for seven years.

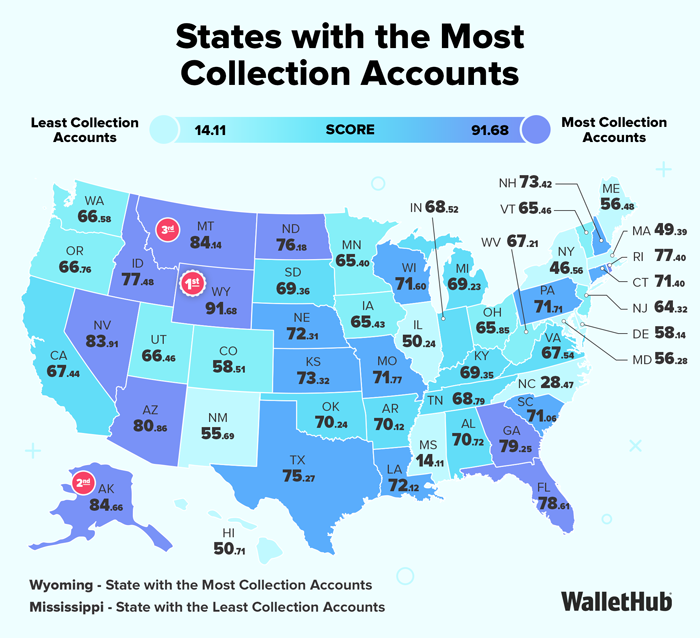

To determine which states have the highest number of collection accounts—and therefore where residents’ credit scores and financial stability may be most at risk—WalletHub analyzed all 50 states using four key metrics. These included the average number of collection accounts, the average balance owed, and how both figures changed from Q2 2025 to Q3 2025.

Chip Lupo, WalletHub Writer and Analyst

Main Findings

States With the Most and Fewest Collection Accounts

|

Overall Rank* |

State |

Total Score |

Collection Accounts Status Rank |

Change in Average Collection Accounts Rank |

|---|---|---|---|---|

| 1 | Wyoming | 91.68 | 1 | 24 |

| 2 | Alaska | 84.66 | 4 | 3 |

| 3 | Montana | 84.14 | 2 | 34 |

| 4 | Nevada | 83.91 | 3 | 26 |

| 5 | Arizona | 80.86 | 5 | 18 |

| 6 | Georgia | 79.25 | 9 | 12 |

| 7 | Florida | 78.61 | 7 | 20 |

| 8 | Idaho | 77.48 | 8 | 30 |

| 9 | Rhode Island | 77.40 | 13 | 1 |

| 10 | North Dakota | 76.18 | 6 | 42 |

| 11 | Texas | 75.27 | 10 | 31 |

| 12 | New Hampshire | 73.42 | 18 | 7 |

| 13 | Kansas | 73.32 | 16 | 11 |

| 14 | Nebraska | 72.31 | 19 | 15 |

| 15 | Louisiana | 72.12 | 20 | 14 |

| 16 | Missouri | 71.77 | 17 | 23 |

| 17 | Pennsylvania | 71.71 | 24 | 9 |

| 18 | Wisconsin | 71.60 | 22 | 16 |

| 19 | Connecticut | 71.40 | 21 | 19 |

| 20 | South Carolina | 71.06 | 12 | 40 |

| 21 | Alabama | 70.72 | 27 | 10 |

| 22 | Oklahoma | 70.24 | 23 | 25 |

| 23 | Arkansas | 70.12 | 33 | 8 |

| 24 | South Dakota | 69.36 | 11 | 45 |

| 25 | Kentucky | 69.35 | 38 | 2 |

| 26 | Michigan | 69.23 | 34 | 13 |

| 27 | Tennessee | 68.79 | 26 | 33 |

| 28 | Indiana | 68.52 | 31 | 27 |

| 29 | Virginia | 67.54 | 32 | 32 |

| 30 | California | 67.44 | 40 | 5 |

| 31 | West Virginia | 67.21 | 35 | 28 |

| 32 | Oregon | 66.76 | 28 | 38 |

| 33 | Washington | 66.58 | 29 | 39 |

| 34 | Utah | 66.46 | 14 | 48 |

| 35 | Ohio | 65.85 | 37 | 29 |

| 36 | Vermont | 65.46 | 25 | 44 |

| 37 | Iowa | 65.43 | 36 | 37 |

| 38 | Minnesota | 65.40 | 39 | 22 |

| 39 | New Jersey | 64.32 | 41 | 17 |

| 40 | Colorado | 58.51 | 43 | 35 |

| 41 | Delaware | 58.14 | 15 | 50 |

| 42 | Maine | 56.48 | 30 | 49 |

| 43 | Maryland | 56.28 | 44 | 41 |

| 44 | New Mexico | 55.69 | 42 | 47 |

| 45 | Hawaii | 50.71 | 46 | 6 |

| 46 | Illinois | 50.24 | 45 | 21 |

| 47 | Massachusetts | 49.39 | 48 | 4 |

| 48 | New York | 46.56 | 47 | 36 |

| 49 | North Carolina | 28.47 | 49 | 46 |

| 50 | Mississippi | 14.11 | 50 | 43 |

Notes: *No. 1 = Most Collection Accounts

With the exception of “Total Score,” the columns in the table above depict the relative rank of each state, where a rank of 1 represents the worst conditions for that category.

In-Depth Look at the States With the Most Collection Accounts

Wyoming

Wyoming is the state with the most collection accounts, with an average of more than four accounts per resident in collections. Wyoming also has the highest average balance per collection account, at $2,024. That’s a sizable amount of money to be liable for, particularly if you have more than one delinquent account.

Wyoming saw only a small increase in the number of collection accounts per person, relatively modest compared with other states. However, Wyoming recorded the fourth-largest increase in average balance between Q2 and Q3 2025, indicating that while the number of accounts isn’t rising sharply, the amounts owed are growing much more significantly.

Alaska

Alaska has the second-most collection accounts, with an average of over three collection accounts per resident in collections. The average balance per account is $1,687, which is the eighth-highest in the country.

Alaska ranks in the top half of the country in recent jumps in both the number and size of collection accounts. Residents experienced the third-highest increase in average balance between Q2 and Q3 2025, along with the 15th-highest increase in the number of accounts per person.

Montana

Montana ranks third, with an average of around three collection accounts per resident in collections. Montana residents also have the third-highest balance per collection account, at $1,805.

The average collection account balance in Montana rose by 1.42% between Q2 and Q3 2025, the 11th-highest increase in the country. There was also a slight uptick (0.6%) in the number of collection accounts per person. This pattern may indicate that balances are growing even as residents take on a small number of additional collection accounts.

Ask the Experts

To explore how collection accounts impact credit and personal finances, we asked a panel of experts to share their insights on the following questions:

- What are the best ways to avoid debts being sent to collections?

- How does having collection accounts impact your credit score?

- What is the best strategy to deal with a debt in collections and protect your finances?

- Are closed accounts bad for your credit report? Why or why not?

Ask the Experts

MSM, PHR – Business Professor, Financial Literacy Instructor & Entrepreneur - Atlanta Metropolitan State College, Adjunct Business Professor - Langston University

Read More

Ph.D. – Associate Professor of Practice, Finance - Rutgers School of Business–Camden

Read More

M.A., Consumer Affairs Program - Dept. of Family and Consumer Sciences, College of Health and Human Services - California State University, Long Beach

Read More

Methodology

In order to determine the states with the most and least collection accounts, WalletHub compared the 50 states across two key dimensions: 1) Collection Accounts Status and 2) Change in Average Collection Accounts.

We evaluated those dimensions using 4 relevant metrics listed below with their corresponding weights, each metric being graded on a 100-point scale.

Finally, we determined each state's weighted average across all metrics to calculate its overall score and used the resulting scores to rank-order our sample.

Collection Accounts Status – Total Points: 75

- Average No. of Collection Accounts in Q3 2025 (per Resident in Collections): Double Weight (~50.00 Points)

- Average Collection Account Balance per Tradeline in Q3 2025: Full Weight (~25.00 Points)

Change in Average Collection Accounts – Total Points: 25

- Change in Average No. of Collection Accounts (per Resident in Collections) from Q2 to Q3 2025: Full Weight (~12.50 Points)

- % Change in Average Collection Account Balance per Tradeline from Q2 to Q3 2025: Full Weight (~12.50 Points)

Sources: Data used to create this ranking were collected as of December 18, 2025 from WalletHub database.

WalletHub experts are widely quoted. Contact our media team to schedule an interview.