A checking account is the primary instrument in most consumers’ financial toolboxes. As the most basic and versatile type of bank account, it can be used to pay bills, make everyday purchases, receive direct deposits and safely store funds in a government-insured account.

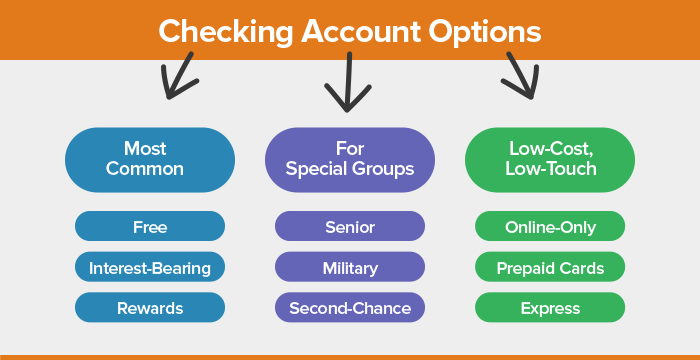

Checking accounts (or “share draft accounts” at credit unions) can be divided into three major account categories, each targeted at a different type of user: the general consumer, the small business owner and the college student.

Within each category, the options range from “free accounts” to more specific types such as those for seniors or consumers on the go. We describe each type in this guide.

Most checking accounts offer the same basic services, but with any account you need to watch out for fees. Even “free” accounts can rack up costly charges that range from the monthly service fee to dormant account fees. Check out WalletHub’s Banking Landscape Report to learn more about the costs of having a checking account. Then use WalletHub’s comparison tool to find the best checking account deal in your category and filter the results according to your needs.

Most Common Types of Accounts

- Free: A checking account with the word “free” in its name doesn’t mean you won’t ever pay any fees; it simply means you won’t be charged a monthly fee for keeping the account open. By shopping around, you can find checking accounts that don’t charge a monthly fee even if you don’t keep a minimum balance. You’ll have more options to avoid monthly fees if you can maintain a minimum balance or if you enroll in direct deposit of your paycheck or government payments.Features included in free checking accounts vary, but in general you won’t pay for online banking services, bill pay, direct deposit, ACH transfers and mobile banking. In some cases, you may be able to get free printed checks or surcharge-free access to any ATM.

- Interest-Bearing: This type of account comes with the same bells and whistles as any other checking account. The key benefit is your ability to earn monthly interest on your balance.To avoid monthly fees on an interest-bearing account, you’ll generally need to maintain a higher minimum balance than you would on an account that pays no interest. Given today’s very low interest rates on checking deposits, you should make sure you’re not paying more in fees than you’re earning back in interest.

- Rewards: Some banks and credit unions offer accounts that reward customers for certain banking activities such as paying bills online, making a certain number of debit purchases per month or signing up for direct deposit. Rewards can take the form of miles, points or cash back. But not everyone can open a rewards checking account, and, as with interest checking, rewards accounts may require a higher minimum balance than non-rewards accounts.

Accounts for Special Groups

If you fall into one of the groups below, you may be able to choose from an account that is tailored to your needs.

- Senior: Many banks and credit unions offer cost-effective checking options for adults aged 55 and older. Senior accounts — also known as “Prime Time accounts” — tend not to charge a monthly fee, and with this account type, you can have your Social Security payments and other retirement benefits directly deposited to your accounts.Additional benefits vary by institution but often include free checks, including cashier’s and traveler’s checks; free ATM transactions; and favorable interest rates on loans and credit cards. You can even score discounts on travel and prescriptions.

- Military: Members of the armed forces — active-duty, veterans and retirees — enjoy exclusive benefits and some of the best checking account offers on the market. Military checking accounts typically are free, with few other differences from a standard checking account. Some military checking accounts can even earn interest.Other perks vary but are commonly the same as those on free accounts, which often waive the minimum balance requirement. With some military accounts, the bank also won’t require a minimum opening deposit.

- Second-Chance: Whenever you apply for a checking account, the financial institution first checks your previous banking history. If it finds an unsatisfactory record (e.g., involuntary closure of your account because of multiple overdrafts), you most likely won’t qualify for a standard checking account.Although you will likely pay higher fees, second-chance checking gives you an opportunity to rebuild a positive banking record so that you can qualify for better deals on checking in the future. And they’re safe with government-backed insurance. You can compare different second-chance checking options at banks or credit unions that offer them.

Low Cost & Low Touch Accounts

Many banks offer accounts designed specifically for consumers who seek the simplest option for a checking account.

- Online-Only: Virtual financial institutions offer the best interest rates on personal accounts and charge fewer and cheaper fees than most traditional banks and credit unions. The biggest drawback is a lack of physical branch locations. However, many offer surcharge-free access to any ATM to make up for that.

- Prepaid Card: Increasing in popularity as a replacement checking account, a prepaid card is essentially a checking account without the physical checkbook. But because you’re limited to spending the cash you’ve deposited, or “loaded,” into your account, there’s no risk of ever overdrawing your account or incurring overdraft fees. When your balance runs low, you can easily reload your account online or at thousands of locations across the U.S.On WalletHub, you can compare the best prepaid card deals. Keep in mind that prepaid cards come with their own associated fees and costs, so factor those in to your considerations as you shop for the right card.

- Express: If you seldom set foot in a bank branch and plan to do most, if not all, of your banking through an ATM, by phone or online, an express checking account may be right for you. With this account type, your bank assumes you won’t need to make in-person transactions, so you’ll pay a “teller” fee for every additional teller visit you make after the first one or two, which are usually free.

WalletHub experts are widely quoted. Contact our media team to schedule an interview.