Balancing a checkbook is easy. The task involves recording every withdrawal and every deposit you’ve made in the recent past and will make in the near future. Once you’ve done so, you’ll need basic math skills and a few minutes each day or month to verify the accuracy of your work and to calculate a running balance.

And it’s important to do so for two key purposes:

- To know how much money is actually available in your checking account at any point in time — partly so you don’t overdraw your balance; and

- To reconcile your checking account with your bank statement, which allows you to spot errors (or even fraudulent activity) and to account for any transactions you may have overlooked in your bookkeeping.

Read on for instructions on how to balance your checkbook (including a visual example) and reconcile your bank statement through both traditional and modern methods. You can also get tips for using your check register and keeping an account in good standing.

How To Balance Your Checkbook

To keep track of how much money you actually have in the bank in order to avoid surprises and costly fees, you should keep an accurate running balance of your account at all times. And there are two main avenues for doing so: 1) maintaining a paper check register, or 2) leveraging mobile and online banking tools.

Realize, however, that while electronic banking has expanded your options for this process, the new era of automated payments has also complicated record-keeping procedures, which now require the ability to anticipate recurring and “digital check” transactions. We’ll address that issue in more detail in the “How To Balance Your Checkbook In The Electronic Banking Era” section.

For now, you need to grasp the following methods for keeping track of your account activity:

- Record transactions, including checks, in your checkbook register as you make them (see next section for instructions).

- Get a book of “duplicate” checks that allows you to keep a carbon copy of every check you write.

- Save your pay stubs as well as receipts of ATM withdrawals (making a note of ATM fees), debit card purchases and deposits.

- Use online bill pay and record recurring/automatic payments in advance.

- Review your monthly bank statement or online banking history to get details on fees and interest payments, if any.

Periodically, you’ll need to sit down with these records and sum up the transactions to reconcile your bank statement. The next two sections discuss both old and new ways of doing so.

How To Use A Check Register

A check register is like a diary of your checking account activity, and every box of checks you order from your bank will come with one. You use it to record every incoming and outgoing transaction in your account. This method originated from a time when writing checks was the primary way of making payments out of your checking account. But it’s nonetheless still a useful tool. Keeping track of all your account activity and maintaining a running balance gives a good idea of how much money is in your account at any given time.

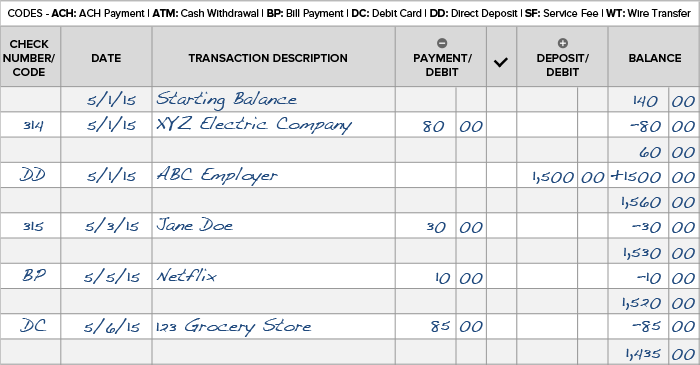

If you prefer this pre-digital-era method and want to be thorough in your bookkeeping, follow the steps to using a check register below while referring to the visual example:

- Enter transactions in the white rows of your check register while they’re still fresh in your memory. Use the gray rows to add a memo or transaction category under the “Transaction Description” column and to enter your new running balance under the “Balance” column. As you do, keep the following rules in mind:

- Amounts for checks you issue, debit card purchases, ATM withdrawals, ACH payments you make, outbound wire transfers and bank service charges go under the “Debit (-)” column. Every time you make a debit entry, subtract that amount from your prior balance, and record the difference in the “Balance” column.

- Amounts for cash or check deposits, direct deposits, interest earnings and incoming transfers (ACH or wire) go under the “Credit (+)” column. Add these to your prior balance, and record the sum in the “Balance” column.

- Every month — or sooner if you wish — you need to reconcile your own records against your bank statement. You can do this by comparing your check register against your monthly bank statement or online banking history.

- Place a checkmark next to each transaction in your check register as you match it up with your bank statement or online banking history. That way you’ll know which transactions are still pending.

- Subtract the pending transactions from your check register balance for the same statement period. Your check register balance and bank statement ending balance should then be equal. If not, call your bank about any transactions you don’t recognize.

How To Balance Your Account In The Electronic Banking Era

Americans rely less on paper checks than they used to, opting instead to use electronic payment options, according to the National Automated Clearing House Association. This makes balancing your checkbook harder because physical checks are no longer the only way money moves in or out of your account.

This adds an extra step to balancing your checkbook: forecasting future transactions. In addition to ATM withdrawals and debit card purchases, for which you can save receipts, you also need to account for:

- Online bill payments you schedule

- Automatic electronic withdrawals you set up outside of your bank account (e.g., the $8.99 payment Netflix pulls from your account every month or the cell phone bill you paid with your debit card on your carrier’s website)

- Direct deposits of your paycheck or benefits payments

But you still need to follow the same record-keeping procedures:

- List what won’t be included in your online account balance, including pending bill pay transactions and pending withdrawals. If you’re relying on your bank to do the math for you, make sure to check for inaccuracies and to factor in outstanding transactions that have yet to post on your online banking history.

- File or toss away receipts once you’ve confirmed them against your online banking history.

- If you use a credit card for daily purchases, keep aware of your revolving credit card balance, which could be different every month. Your goal should be to pay this off in full by every statement due date, so charging too much on your credit card can affect the future balance of the checking account you use to pay your bill.

Tips For Maintaining Your Check Register & Positive Banking Record

Missing a payment or overdrawing your account can have costly financial — sometimes legal — consequences. You’ll not only owe the person or business you intended to pay, but you could also rack up hefty fees, hurt your credit score and banking history, or even be sued. So it’s useful to establish good record-keeping habits now, including those below, to avoid complications in the future.

- Don’t Exclude Any Transactions: Enter all transactions in your check register, including even tiny amounts of interest that your account may have earned and service fees your bank charges you. Making a practice of doing so will help you avoid small discrepancies when reconciling your bank statement.

- Record Transactions As They Happen: Don’t wait to record a transaction, especially checks, in your check register. Enter it as it occurs or at least at the end of each day while transactions are still fresh in your mind. Of course, receipts will always come in handy later, so make sure to keep them in a central folder.

- Avoid Overdrawing Your Account: Don’t write a check unless your account has adequate funds to cover it. Because check-clearing times vary considerably by bank and by transaction, it’s in your best interest to stay informed of your actual account balance from balancing your checkbook.

- Get Account-Balancing Software: Take advantage of personal-finance apps such as the desktop-based Quicken or cloud-based Mint. These programs can help you keep tabs on your expenses and deposits without having to record them in a paper check register, and they can be configured to automatically pull statement data from your bank’s online banking system. Many of these apps even allow you to view your account activity on your smartphone for convenient tracking, and some feature a “balance and reconcile” function.

- Set Up Alerts For Recurring Transactions: You can avoid missing payments by setting up text or email notifications of upcoming bills or scheduling reminders on your desktop or online calendar.

WalletHub experts are widely quoted. Contact our media team to schedule an interview.