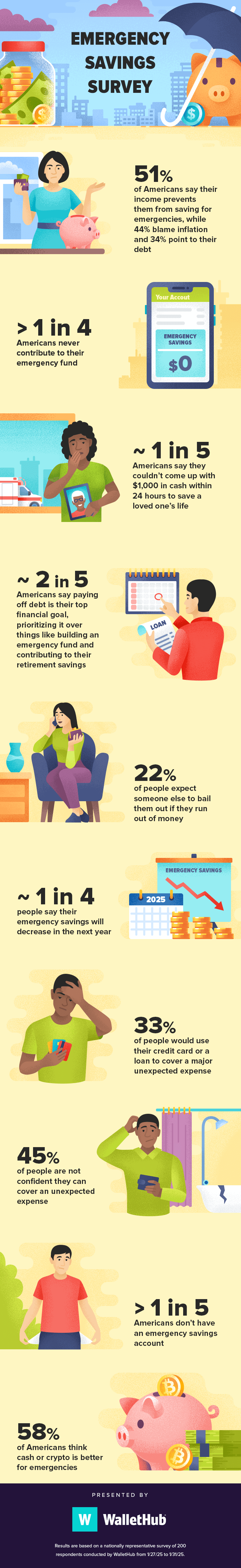

Having emergency savings is important because it prevents your finances from unraveling due to unexpected life events, such as hospitalization, auto repairs, or sudden unemployment. Ideally, your emergency fund should be able to cover at least three to six months’ worth of expenses. However, saving that much money can be very difficult in the current economic environment. For example, in a new, nationally representative survey conducted by WalletHub, 44% of respondents said that inflation prevents them from saving for emergencies.

WalletHub’s survey asked a variety of questions about people’s emergency savings, their ability to handle unexpected expenses, and the impact of inflation. You can check out the results below.

Key Stats

- No Room to Save: 51% of Americans say their income prevents them from saving for emergencies, while 44% blame inflation and 34% point to their debt.

- Skipping the Safety Net: More than 1 in 4 Americans never contribute to their emergency fund.

- No Savings to Save the Day: Nearly 1 in 5 Americans say they couldn’t come up with $1,000 in cash within 24 hours to save a loved one’s life.

- Debt First, Savings Later: Nearly 2 in 5 Americans say paying off debt is their top financial goal, prioritizing it over things like building an emergency fund and contributing to their retirement savings.

- Hoping for a Bailout: 22% of people expect someone else to bail them out if they run out of money.

- Shrinking Savings Ahead: Nearly 1 in 4 people say their emergency savings will decrease in the next year.

Ask the Experts

To gain further insight on building and using emergency savings, we posed the following questions to a panel of experts. Click on the experts’ profiles to read their bios and responses.

- How much money do you recommend people save in an emergency fund?

- What strategies can people pursue in order to increase their emergency fund savings?

- What is your advice to people who are already dipping into their emergency funds due to inflation?

- What is the best way to handle an emergency expense when your emergency fund can’t cover it?

Ask the Experts

CPA/PFS CGMA – Assistant Teaching Professor, Accounting; Program Coordinator of the Accounting Program; Program Coordinator of the Financial Planning Program – Florida State University, Panama City

Read More

University Faculty of Business – Purdue University Global

Read More

Ph.D., CFA, CFP® – Associate Professor of Finance, Lariccia School of Accounting and Finance, Williamson College of Business Administration – Youngstown State University

Read More

Associate Professor of Practice, Director of the Herbert D. Weitzman Institute For Real Estate – The University of Texas at Dallas

Read More

Ph.D., CFA – Associate Professor| UFF-FAMU Labor Union President| Investments and Analytics Lab Director – Florida A&M University, School of Business & Industry

Read More

Full Survey & Responses

| How long could your emergency savings cover your expenses? | |

|---|---|

| 6 months or more | 34% |

| 3 to 5 months | 27% |

| No emergency savings | 20% |

| Less than 3 months | 19% |

| Are you confident that you’d be able to cover any unexpected expense? | |

| Yes | 55% |

| No | 45% |

| Which financial goal is your biggest priority? | |

| Paying off debt | 37% |

| Contributing to retirement savings | 30% |

| Building emergency savings | 18% |

| Saving for a house | 11% |

| Improving credit score | 4% |

| What hinders your ability to save for emergencies? (select all that apply) | |

| My income | 51% |

| Inflation | 44% |

| My debt | 34% |

| My life choices | 27% |

| The decisions of others | 15% |

| Do you expect someone else to bail you out if you run out of money? | |

| No | 78% |

| Yes | 22% |

| How would you approach paying for a major unexpected expense? | |

| Use my emergency savings | 40% |

| Use a credit card or loan | 33% |

| Withdraw from my retirement savings | 15% |

| Borrow money from family or friends | 13% |

| Could you come up with $1,000 in cash within 24 hours to save a loved one’s life? | |

| Yes | 84% |

| No | 16% |

| How frequently do you contribute to your emergency savings account? | |

| Once per month | 47% |

| Never | 27% |

| Once per quarter | 20% |

| Once per year | 6% |

| Is cash or crypto better for emergencies? | |

| Yes | 58% |

| No | 42% |

| Will your emergency savings increase or decrease in the next year? | |

| Increase | 76% |

| Decrease | 24% |

Note: Percentages may not total 100% due to rounding.

Methodology

This report reflects the results of a nationally representative online survey of 200 respondents.

After we collected all responses, we normalized the data by gender and income so that the sample would reflect U.S. demographics

WalletHub experts are widely quoted. Contact our media team to schedule an interview.