Popular Barclays Credit Cards With Good Reviews

Keep in mind that Barclays only has a few credit cards that are unaffiliated with a retailer or travel provider. While you won't be locked into a merchant-specific rewards program with these cards, you will likely find them to be too expensive with too few rewards to be worthwhile.

In addition to user reviews, you should consider the WalletHub Ratings for Barclays credit cards when comparing offers. WalletHub Ratings are based on a proprietary 100-point scoring system and reflect how satisfied customers are, how competitive a card is with the market as a whole and how strong WalletHub's editors think the offer is.

Compare Barclays Credit Cards

Not Offered

0% for 15 months|Transfer Fee: 5% (min $5)

19.74% - 27.74% (V)

annual fee

$1,199

rewards rate

1 - 2 point / $1

Good

Pros

- 0% intro APR on balance transfers

- High rewards rate

- No foreign fee

Cons

- High membership fees

- No initial rewards bonus

- No intro APR on purchases

- Balance transfer fee

Rewards Details

- Earn 1 point for every $1 spent on this card. Receive 2% Value for Cash Back direct deposit into a US bank account or as a statement credit.

- Earn 2 points per $1 spent on eligible hotel and airfare purchases booked through LuxuryCardTravel.com.

- 2% Value for Airfare Redemption. 50,000 Points will get you a $1,000 ticket on any airline with no blackout dates or seat restriction.

- Receive up to $300 in annual air travel credits toward flight-related purchases, including airline tickets, baggage fees, upgrades and more. Plus, $120 automatic statement credit for the cost of the Global Entry Application Fee.

- Enjoy $500 value per stay through Luxury Card Travel program at 3,000+ global properties. Benefits include room upgrade at check-in (when available), daily breakfast for two, complimentary Wi-Fi, and unique amenity.

- Unlock $5 Lyft App credit monthly after 3 rides. Limit one Lyft credit per calendar month.

- Get three months of Instacart+ complimentary and $10 off your second order each month, plus a $3 statement credit each month with Peacock with your Mastercard® Gold Card.

- Enjoy complimentary access to more than 1,700 lounges in over 600 cities worldwide with Priority Pass™ Select.

- Get up to $200 in annual statement credits when you use your Mastercard® Gold Card at qualifying restaurants. Plus, receive up to $200 in credits annually with Ship&Play.

Additional Info

- 0% Introductory APR on balance transfers that post to your account within 45 days of account opening.

- $349 Annual Fee for each Authorized User added to the account.

- Luxury Card Concierge, 24 hours a day, 365 days a year.

- 24K Gold Plated/Carbon Card – Patented Design.

- Privileged access to exclusive events and insider opportunities.

- Benefits: Travel Accident Insurance, Baggage Delay Insurance, Auto Rental Collision Waiver, Travel Assistance, and Trip Cancellation & Interruption.

- Mastercard ID Theft Protection.

Not Offered

0% for 15 months|Transfer Fee: 5% (min $5)

19.74% - 27.74% (V)

annual fee

$699

rewards rate

1 - 2 point / $1

Good

Pros

- 0% intro APR on balance transfers

- High rewards rate

- No foreign fee

Cons

- High membership fees

- No initial rewards bonus

- No intro APR on purchases

- Balance transfer fee

Rewards Details

- Earn 1 point for every $1 spent on this card. Receive 1.5% Value for Cash Back direct deposit into a US bank account or as a statement credit.

- Earn 2 points per $1 spent on eligible hotel and airfare purchases booked through LuxuryCardTravel.com.

- 2% Value for Airfare Redemption. 50,000 Points will get you a $1,000 ticket on any airline with no blackout dates or seat restriction.

- Receive up to $200 in annual air travel credits toward flight-related purchases, including airline tickets, baggage fees, upgrades and more.

- Get up to $100 in annual statement credits when you use your Luxury Card at qualifying restaurants.

- Plus, $120 automatic statement credit for the cost of the Global Entry Application Fee.

- Enjoy $500 value per stay through Luxury Card Travel program at 3,000+ global properties. Benefits include room upgrade at check-in (when available), daily breakfast for two, complimentary Wi-Fi, and unique amenity.

- Unlock $5 Lyft App credit monthly after 3 rides. Limit one Lyft credit per calendar month.

- Get three months of Instacart+ complimentary and $10 off your second order each month with your Mastercard® Black Card.

- Get a $3 statement credit each month with Peacock, when you use your Mastercard® Black Card.

- Airport Lounge Access with Priority Pass™ Select.

Additional Info

- 0% Introductory APR on balance transfers that post to your account within 45 days of account opening.

- $249 Annual Fee for each Authorized User added to the account.

- Black-PVD-Coated Metal Card.

- Luxury Card Concierge, 24 hours a day, 365 days a year.

- Privileged access to exclusive events and insider opportunities.

- Access to the Tournament Players Club (TPC) network of private club courses and Priceless® Surprises.

- Benefits: Travel Accident Insurance, Baggage Delay Insurance, Auto Rental Collision Waiver, Travel Assistance, and Trip Cancellation & Interruption.

- Mastercard ID Theft Protection.

Not Offered

0% for 12 months|Transfer Fee: 5% (min $5)

19.74% - 29.99% (V)

annual fee

$499

rewards rate

1 - 3 miles / $1

Bonus Offer

50,000 miles

Bonus Offer

50,000 miles

Excellent

Pros

- 0% intro APR on balance transfers

- High rewards rate

- 50,000 miles initial rewards bonus

- No foreign fee

Cons

- High membership fees

- No intro APR on purchases

- Balance transfer fee

- Requires excellent credit

Rewards Details

- Earn 50,000 bonus Skywards Miles after spending $3,000 on purchases in the first 90 days.

- Enjoy Emirates Skywards Gold membership during your first year and retain your tier status by spending $40,000 each cardmembership year.

- Earn 3 Skywards Miles for every $1 spent on emirates.com or at the Emirates Sales office.

- Earn 2 Skywards Miles for every $1 spent on eligible airfares, hotel stays and car rentals and 1 Skywards Mile on all other purchases.

- Earn 10,000 Skywards Miles anniversary bonus after spending $30,000 each cardmembership year.

- Global Entry or TSA PreCheck application fee credit every five years – up to $120.

- Receive a 25% discount on the purchase of Skywards Miles when you buy or gift Skywards Miles.

Additional Info

- 0% introductory APR on balance transfer that post to your account within 45 days of account opening.

- Unlimited access to over 1,200 lounges worldwide for you and your guests with Priority Pass™ Select.

Not Offered

Not Offered

33.49% (V)

annual fee

$0

rewards rate

1 - 5 points / $1

Bonus Offer

20% discount

Bonus Offer

20% discount

Good

Pros

- No membership fees

- High rewards rate

- 20% discount initial rewards bonus

Cons

- No intro APR on purchases

- No intro APR on balance transfers

- Foreign fee

- Requires good/excellent credit

Rewards Details

- Receive 20% off your first purchase made at Gap within 14 days of account opening.

- Earn 5 points for every $1 spent at Gap, Banana Republic, Old Navy, and Athleta, and 1 point for every $1 spent on all Mastercard purchases made outside the family of brands.

- 100 points = $1 reward redeemable across the family of brands, no merchandise restrictions.

- Free fast shipping on all online orders $50 or more.

- Cardmembers will unlock the Icon membership status on total qualifying purchases of $1,000 at family of brands or by earning 5,000 base points during a calendar year. Terms apply.

Additional Info

- Early Access to select sales.

- Members Only Exclusive Offers.

- By applying, you agree that you’ll first be considered for the GAP Credit Card which can be used anywhere Mastercard is accepted. If not approved for the GAP Credit Card, you’ll then automatically be considered for the GAP Store Card which can be used across all Gap Inc. stores and online.

Not Offered

Not Offered

33.49% (V)

annual fee

$0

rewards rate

1 - 5 points / $1

Bonus Offer

30% discount

Bonus Offer

30% discount

Good

Pros

- No membership fees

- High rewards rate

- 30% discount initial rewards bonus

Cons

- No intro APR on purchases

- No intro APR on balance transfers

- Foreign fee

- Requires good/excellent credit

Rewards Details

- Receive 30% off your first purchase at Old Navy with your card within 14 days of account opening.

- Earn 5 points for every $1 spent at Gap, Banana Republic, Old Navy, and Athleta, and 1 point for every $1 spent on all Mastercard purchases made outside the family of brands.

- 100 points = $1 reward redeemable across the family of brands, no merchandise restrictions.

- Free fast shipping on all online orders $50 or more.

- Cardmembers will unlock the Icon membership status on total qualifying purchases of $1,000 at family of brands or by earning 5,000 base points during a calendar year. Terms apply.

Additional Info

- Early Access to select sales.

- Members Only Exclusive Offers.

- By applying, you agree that you’ll first be considered for the Old Navy Credit Card which can be used anywhere Mastercard is accepted. If not approved for the Old Navy Credit Card, you’ll then automatically be considered for the Old Navy Store Card which can be used across all Gap Inc. stores and online.

Not Offered

Not Offered

33.49% (V)

annual fee

$0

rewards rate

1 - 5 points / $1

Bonus Offer

20% discount

Bonus Offer

20% discount

Good

Pros

- No membership fees

- High rewards rate

- 20% discount initial rewards bonus

Cons

- No intro APR on purchases

- No intro APR on balance transfers

- Foreign fee

- Requires good/excellent credit

Rewards Details

- Receive 20% off your first purchase made at Banana Republic with your card within 14 days of account opening.

- Earn 5 points for every $1 spent at Gap, Banana Republic, Old Navy, and Athleta, and 1 point for every $1 spent on all Mastercard purchases made outside the family of brands.

- 100 points = $1 reward redeemable across the family of brands, no merchandise restrictions.

- Free fast shipping on all online orders $50 or more.

- Cardmembers will unlock the Icon membership status on total qualifying purchases of $1,000 at family of brands or by earning 5,000 base points during a calendar year. Terms apply.

Additional Info

- Early Access to select sales.

- Members Only Exclusive Offers.

- By applying, you agree that you’ll first be considered for the Banana Republic Credit Card which can be used anywhere Mastercard is accepted. If not approved for the Banana Republic Credit Card, you’ll then automatically be considered for the Banana Republic Store Card which can be used across all Gap Inc. stores and online.

Not Offered

0% for 15 months|Transfer Fee: 5% (min $5)

19.74% - 27.74% (V)

annual fee

$299

rewards rate

1 - 2 point / $1

Good

Pros

- 0% intro APR on balance transfers

- High rewards rate

- No foreign fee

Cons

- High membership fees

- No initial rewards bonus

- No intro APR on purchases

- Balance transfer fee

Rewards Details

- Earn 1 point for every $1 spent on this card. Receive 1% Value for Cash Back direct deposit into a US bank account or as a statement credit.

- Earn 2 points per $1 spent on eligible hotel and airfare purchases booked through LuxuryCardTravel.com.

- 2% Value for Airfare Redemption. 50,000 Points will get you a $1,000 ticket on any airline with no blackout dates or seat restriction.

- Enjoy $500 value per stay through Luxury Card Travel program at 3,000+ global properties. Benefits include room upgrade at check-in (when available), daily breakfast for two, complimentary Wi-Fi, and unique amenity.

- Unlock $5 Lyft App credit monthly after 3 rides. Limit one Lyft credit per calendar month.

- Get three months of Instacart+ complimentary and $10 off your second order each month with your Mastercard® Titanium Card.

- Get a $3 statement credit each month with Peacock, when you use your Mastercard® Titanium Card.

- Enjoy amenities such as room upgrades, complimentary food and beverage, spa credits and more.

Additional Info

- 0% Introductory APR on balance transfers that post to your account within 45 days of account opening.

- $149 Annual Fee for each Authorized User added to the account.

- Brushed Metal Card.

- Luxury Card Concierge, 24 hours a day, 365 days a year.

- Benefits: Travel Accident Insurance, Baggage Delay Insurance, Auto Rental Collision Waiver and Trip Cancellation & Interruption.

Not Offered

0% for 12 months|Transfer Fee: 5% (min $5)

19.74% - 29.74% (V)

annual fee

$0

rewards rate

1 - 3 points / $1

Bonus Offer

10,000 points

Bonus Offer

10,000 points

Good

Pros

- No membership fees

- 0% intro APR on balance transfers

- High rewards rate

- 10,000 points initial rewards bonus

Cons

- No intro APR on purchases

- Balance transfer fee

- Requires good/excellent credit

Rewards Details

- Earn 10,000 TrueBlue bonus points after spending $1,000 on purchases in the first 90 days.

- Earn 3 points per $1 spent on JetBlue purchases; 2 points per $1 at restaurants and grocery stores and 1 point per $1 on all other purchases.

- Redeem for any seat, any time on JetBlue operated flights, along with no blackout dates and points awarded into your account don’t expire.

- Earn and share points with family and friends through Points Pooling.

- Get 50% savings on eligible inflight purchases like cocktails, beer, wine and meals on JetBlue-operated flights.

Additional Info

- 0% Introductory APR on balance transfer that post to your account within 45 days of account opening.

- $0 Fraud Liability protection for unauthorized charges.

0% for 6 months

0% for 15 months|Transfer Fee: 5% (min $5)

19.49% - 29.74% (V)

annual fee

$0

rewards rate

1 - 5 points / $1

Bonus Offer

30,000 points

Bonus Offer

30,000 points

Good

Pros

- No membership fees

- 0% intro APR on purchases

- 0% intro APR on balance transfers

- High rewards rate

Cons

- Balance transfer fee

- High regular APR

- Requires good/excellent credit

Rewards Details

- Earn 30,000 bonus points after spending $1,000 on purchases in the first 90 days.

- Limited-time offer: Earn 10 points per $1 spent on Sunoco gas through December 31, 2025.

- Earn 5 points per $1 spent on eligible purchases made at hotels by Wyndham and on qualifying gas purchases.

- Earn 2 points per $1 spent on eligible dining and grocery store purchases (excluding Target® and Walmart®), and 1 point per $1 on all other purchases.

- Earn 7,500 bonus points each anniversary year after spending $15,000 on eligible purchases.

- Get free nights faster by redeeming 10% fewer points when you book free nights.

- Wyndham Rewards points can be used for a number of different purposes, including free nights at Wyndham hotels, gift cards, car rental discounts, free airline tickets, airline miles, and merchandise.

- Automatically receive a Wyndham Rewards Gold Membership and enjoy perks like free WiFi, preferred room selection, late checkout, and more.

Additional Info

- 0% Introductory APR on balance transfers that post to your account within 45 days of account opening.

- 0% APR on all Wyndham Timeshare Purchases for six billing cycles.

- Zero liability protection against unauthorized use of card.

- There are two versions of this card, a Signature or Platinum account with different costs and/or benefits. All details expressed here are for the Signature account. If you are not approved for a Signature account you may be approved for a Platinum account.

Not Offered

0% for 15 months|Transfer Fee: 5% (min $5)

19.49% - 29.74% (V)

annual fee

$0

rewards rate

1 - 5 points / $1

Bonus Offer

5,000 points

Bonus Offer

5,000 points

Good

Pros

- No membership fees

- 0% intro APR on balance transfers

- High rewards rate

- 5,000 points initial rewards bonus

Cons

- No intro APR on purchases

- Balance transfer fee

- Requires good/excellent credit

Rewards Details

- Earn 5,000 Bonus Rewards after your first purchase – that’s worth $50 in RCI Member Rewards.

- Earn 5X Rewards for every $1 spent on all eligible RCI purchases.

- Earn 2X Rewards for every $1 spent on all eligible travel purchases including rideshare, gas, and EV charging purchases. And 1X Rewards for every $1 spent on all other purchases.

- Redeem Rewards for RCI Member Rewards credit, statement credits, cash back, worldwide travel, gift cards and more.

- Get 5% Rewards back every time you redeem, as a bonus to use toward your next redemption.

- Earn a $250 Vacation Credit towards one RCI vacation when you spend $10,000 in net purchases each calendar year.

Additional Info

- 0% Introductory APR on balance transfers that post to your account within 45 days of account opening.

Not Offered

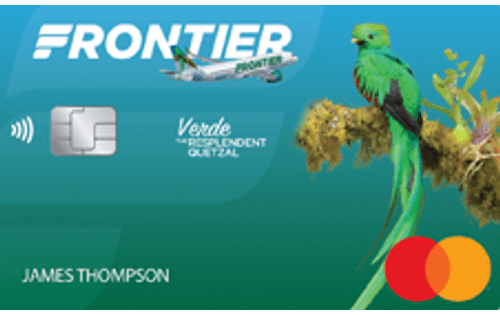

0% for 15 months|Transfer Fee: 5% (min $5)

19.74% - 29.74% (V)

annual fee

$99

rewards rate

1 - 5 miles / $1

Bonus Offer

50,000 miles

Bonus Offer

50,000 miles

Good

Pros

- 0% intro APR on balance transfers

- High rewards rate

- 50,000 miles initial rewards bonus

- No foreign fee

Cons

- Membership fees

- No intro APR on purchases

- Balance transfer fee

- Requires good/excellent credit

Rewards Details

- Earn 50,000 miles after spending $500 and paying the annual fee in full, both within the first 90 days of account opening.

- Earn 5 miles for every $1 of Frontier Airlines net purchases, on tickets, goods and services purchased directly from Frontier Airlines.

- Earn 3 miles for every $1 of net purchases spent at restaurants (categorized as: Restaurants, Bars and Fast Food Restaurants).

- Earn 1 mile for every $1 of net purchases made everywhere else. Keep miles from expiring by making at least one purchase every 12 months.

- Earn instant Elite Gold status after your first purchase within 90 days of account opening, and maintain the status for 12 months by spending $3,000 within the first 90 days.

- Earn a $100 Frontier Airlines Flight Discount Voucher each account anniversary when you spend $2,500 or more in purchases on your account during your cardmembership year.

- Priority boarding allows cardmembers to enjoy Group 4 boarding.

- Spend to Elite Status by earning 1 Elite Status Point for every $1 spent on purchases with your card.

Additional Info

- 0% Introductory APR on balance transfers that post to your account within 45 days of account opening.

- Award redemption fee waiver when you book an award ticket and use your card to pay the related taxes and fees, starting from $5.60 for a one-way ticket.

- Complimentary FICO® Credit Score

Not Offered

0% for 15 months|Transfer Fee: 5% (min $5)

18.74% - 29.74% (V)

annual fee

$0

rewards rate

1 - 2 points / $1

Bonus Offer

20,000 points

Bonus Offer

20,000 points

Good

Pros

- No membership fees

- 0% intro APR on balance transfers

- High rewards rate

- 20,000 points initial rewards bonus

Cons

- No intro APR on purchases

- Balance transfer fee

- Requires good/excellent credit

Rewards Details

- Earn 20,000 bonus points (redeemable for a $200 onboard credit) after spending $1,000 within the first 90 days of account opening.

- Earn 2 points per $1 spent on all Holland America purchases, including onboard purchases.

- Earn 1 point for every $1 spent on all other purchases.

- Redeem points for discounts toward Holland America Cruises, onboard amenities and credits, statement credits toward airfare, along with gift cards and merchandise.

Additional Info

- 0% Introductory APR on balance transfers that post to your account within 45 days of account opening.

- Concierge service provides personal assistance via telephone, including recommendations and reservations.

- There are two versions of this card, a Signature or Platinum account with different costs and/or benefits. All details expressed here are for the Signature account. If you are not approved for a Signature account you may be approved for a Platinum account.

Not Offered

0% for 15 months|Transfer Fee: 5% (min $5)

19.74% - 29.74% (V)

annual fee

$89

rewards rate

1 - 2 miles / $1

Bonus Offer

50,000 miles

Bonus Offer

50,000 miles

Good

Pros

- 0% intro APR on balance transfers

- High rewards rate

- 50,000 miles initial rewards bonus

- No foreign fee

Cons

- Membership fees

- No intro APR on purchases

- Balance transfer fee

- Requires good/excellent credit

Rewards Details

- Earn 50,000 miles after spending $3,000 in purchases within the first 90 days and payment of the annual fee. Plus, earn an additional 20,000 miles after spending $12,000 on purchases within the first 365 days.

- Earn 2 award miles per $1 spent on ticket purchases directly from Miles & More integrated airline partners and 1 award mile per $1 on all other purchases.

- Redeem miles for flight awards and upgrades on Lufthansa, Austrian Airlines, Brussels Airlines, SWISS, Star Alliance Airlines and other partners.

- Receive two one-time use complimentary Lufthansa Business Lounge vouchers, plus a Companion Ticket upon first purchase and on each account anniversary thereafter. Terms Apply.

- Once each year, you can convert 5,000 to 25,000 miles earned on purchases into Points and Qualifying Points. For example, 5,000 miles convert to 20 Points + 20 Qualifying Points.

Additional Info

- 0% Introductory APR on balance transfers that post to your account within 45 days of account opening.

Barclays Bank US Credit Card Reviews

What's Your Rating?

To learn more about this excellent offer, check out our in-depth review: http://wallethub.com/edu/barclaycard-rewards-mastercard-review/25942/

She's had this card since before the pandemic, but sometime in the middle of the pandemic, we noticed that BR had started rolling out these quarterly bonuses for spending outside of their stores. The 5% bonus categories can vary every quarter, covering things like gas, groceries, drug stores, etc. One time it even gave us a "spend X amount anywhere and get 10% back in points" offer.

Normally, we use our Chase Freedom, Discover, and Citi Custom Cash to cover our quarterly 5% rotating bonuses, but once a year, we might have a gap in gas and/or groceries, and more often than not, our BR card has stepped up to fill that gap. The best part, compared to Chase/Discover, is that there's no cap on the 5% rewards.

Thanks to these rotating bonus categories, we haven't had to spend any money out of pocket for the past couple of years at their stores.

Thank God, I paid it off and froze the account; I'm not using that again. But then they had the gall to contact me and tell me that they were reducing my available balance, faulting me for the reasons.

Did you guys even notice that I froze the account? I'm no longer using it. I don't really care if you lower the balance. The fees are excessive, and your offers are misleading.

Barclays Credit Card FAQ

Get answers to your questions about Barclays Credit Card Reviews below. Editorial and user-generated content is not provided, reviewed or endorsed by this issuer. Please keep in mind that it is not a financial institution’s responsibility to ensure all posts and questions are answered. In addition, WalletHub independently collected information for some of the cards on this page.

- Most Popular

- Most Upvotes

Is Barclays a good credit card company?

Barclays is an average credit card company overall, but some Barclays credit cards are good for rewards, 0% APR intro offers, and travel. Barclays credit cards also have a solid user rating of 3.6/5 on WalletHub, based on more than 24,000 reviews.

Reasons Why Barclays Is an Average Credit Card Company

- 3.6/5 average user rating on WalletHub

- 11.5 million cards in circulation

- Initial bonus offers of up to 45,000 points

- 0% introductory APR promotions lasting as long as 15 months

- Annual fees as low as $0

All in all, Barclays is right around average compared to its competitors. While it is good for 0% APR intro offers and rewards, other credit card companies are better for light spenders and building credit.

Is it hard to get a Barclays credit card?

Yes, it is hard to get a Barclays credit card because all Barclays credit cards require at least good credit for approval. Unless your credit score is 700 or higher and you have a lot of income, it will be difficult for you to get approved for a Barclays credit card.

Minimum Credit Score for Notable Barclays Credit Cards

- JetBlue Card: good credit

- Lufthansa Credit Card: good credit

- Wyndham Credit Card: good credit

- Holland America Line Credit Card:...

What is a Barclays credit card?

A Barclays credit card is a card issued by Barclays, a multinational bank based in London. In the U.S., Barclays has issued cards under the "Barclaycard" brand, as well as cards affiliated with major airline, hotel, and cruise loyalty programs.

Credit cards from Barclays are accepted by any retailer that takes credit cards on the Visa or Mastercard network, not just the companies affiliated with Barclaycard. Aside from making purchases, you can also use...

What is the best Barclays cash back credit card?

Barclays Bank U.S. does offer cash back credit cards. One popular option is the AARP Rewards Credit Card, which gives 3% cash back on gas and drug store purchases, 2% on medical expenses and 1% on all other purchases.

Popular Barclays Bank U.S. Cash Back Credit Cards

For more options, check out WalletHub's picks for the best cash back credit cards overall.

Does Barclays hurt your credit?

A loan from Barclays will temporarily hurt your credit score because the company will perform a hard pull of your credit history, which may drop your score by about 5 to 10 points. The new loan will also add to your overall debt load, which hurts your credit score. The negative effects don't have to last long, though.

Over time, a loan from Barclays will help your credit score if you pay the monthly bills by the due date, as...

Important Disclosures

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers. For full transparency, here is a list of our current advertisers.

Advertisers compensate WalletHub when you click on a link, or your application is approved, or your account is opened. Advertising impacts how and where offers appear on this site (including, for example, the order in which they appear and their prevalence). At WalletHub, we try to list as many credit card offers as possible and currently have more than 1,500 offers, but we do not list all available offers or financial service companies.

Advertising enables WalletHub to provide you proprietary tools, services, and content at no charge. Advertising does not impact WalletHub's editorial content including our best credit card picks, reviews, ratings and opinions. Those are completely independent and not provided, commissioned, or endorsed by any issuer, as our editors follow a strict editorial policy.

WalletHub is not a financial advisor. Our goal is to provide you with top-notch content, data, and tools. You are responsible for deciding what financial products and providers are best for your needs.

Irrespective of whether an institution or professional is a paid advertiser, the presence of information on WalletHub does not constitute a referral or endorsement of the institution or professional by us or vice versa.

We work hard to show you up-to-date product terms, however, this information does not originate from us and thus, we do not guarantee its accuracy. Actual terms may vary. Before submitting an application, always verify all terms and conditions with the offering institution. Please let us know if you notice any differences.