What Is Personal Injury Protection (PIP)?

Personal injury protection (PIP) is a type of car insurance that covers expenses like medical bills, lost wages, or funeral costs. PIP covers you and your passengers when you are in a car accident, regardless of fault. PIP insurance, also known as “no-fault” insurance, is required mostly in states with no-fault insurance laws.

Key Things to Know About Personal Injury Protection (PIP)

- PIP auto insurance is required in 12 states.

- 31 states, including California and Illinois, do not offer PIP coverage.

- PIP covers medical expenses, funeral expenses, lost income, childcare expenses, survivors’ loss benefits, and household services.

- PIP does not cover vehicle damage, property damage, or injuries sustained by people outside your car.

- If PIP is available in your state but not required, it is a smart investment if you want additional protection in case of an accident.

What Does PIP Insurance Cover?

Personal injury protection, or PIP insurance, covers medical expenses, loss of income, funeral expenses, and more in the case of an accident, no matter who is at fault.

PIP insurance covers the policyholder and any passengers in the vehicle at the time of an accident. If an individual listed on the policy as an additional driver was driving at the time of the accident, they will also be covered. The policyholder and any additional drivers listed on a policy may also be covered if they are injured in a car accident as a passenger, a pedestrian or while they are biking.

Medical expenses

Covered medical expenses include: ambulance services, medical and surgical treatment, hospital stays, nursing, medication, medical supplies, X-rays, rehabilitation, prostheses, dental care, optical treatment and chiropractic services. In some states medical expenses are reimbursed at less than 100 percent, leaving the consumer responsible for up to 20 percent “coinsurance.”

Funeral expenses

This includes funerals, burials, and cremations.

Lost income

If you or your passengers are unable to work due to your injuries, PIP can help recover some of those wages. If you are self-employed and have to hire substitute employees, PIP can sometimes cover some of this cost as well.

Childcare expenses

If your injuries make it impossible to care for your children, PIP can cover childcare expenses, such as babysitters.

Survivors' loss

PIP can pay for loss of income and replacement services for surviving dependents.

Household services

PIP can cover lawn care or house cleaning expenses if your injuries make it impossible to perform these duties.

Coverage varies by state and insurance company, and protection beyond medical care is often optional, but PIP insurance can include these types of coverage, up to the policy’s limits and after any deductibles.

Learn more about what PIP insurance covers.

What Does PIP Insurance Not Cover?

- Damage to your car.

- Damage to other people’s property.

- Injuries to other drivers involved in an accident.

- Injuries from accidents that occur while a covered driver is using their car to make money.

- Injuries from accidents that are caused intentionally.

- Injuries resulting from accidents that occur while the covered driver is committing a crime, such as fleeing the police.

- Injuries that were caused by an uninsured car owned by you or an immediate family member.

How PIP Insurance Works

Most states that require PIP are no-fault states, which require each person to cover their own medical expenses if they’re injured in an accident, regardless of who is responsible. These states do not permit you to sue other drivers for compensation for your injuries unless they are severe.

The alternative to “no-fault” insurance laws is a “tort” system for paying claims for medical expenses. In tort states, there are no restrictions on the right to sue. Two tort states also require drivers to carry PIP insurance. In the case of an accident in a tort state, PIP insurance provides immediate benefits to injured people in your vehicle, but it does not limit anyone’s right to sue the at-fault driver for damages.

Learn more about how PIP insurance works.

PIP Insurance Requirements by State

Twelve states, shown on the map below, require all drivers to carry at least a minimum amount of PIP insurance.

| State | Minimum Coverage Required |

|---|---|

| Delaware | $15,000 per person $30,000 per accident $5,000 funeral expenses |

| Florida | $10,000 per person $5,000 death benefit |

| Hawaii | $10,000 per person |

| Kansas | $4,500 per person for medical expenses $4,500 for rehab expenses $2,000 funeral expenses $900 per month for disability/loss of income (for one year) $25 per day for in-home expenses (for one year) |

| Massachusetts | $8,000 per person, per accident |

| Michigan* | $0 to $500,000+ per accident |

| Minnesota | $40,000 per person, per accident ($20,000 for medical costs and $20,000 for non-medical expenses like lost wages) $2,000 for funeral expenses |

| New Jersey | $15,000 per person, per accident Up to $250,000 for certain life-altering injuries |

| New York | $50,000 per person $2,000 death benefit 80% of lost income up to $2,000/month (up to three years) $25 per day for services (up to one year) |

| North Dakota | $30,000 per person |

| Oregon | $15,000 per person $3,000 per month for lost income (up to one year) $5,000 for funeral expenses $30 per day for household services (up to one year) $25 per day for childcare (up to $750) |

| Utah | $3,000 per person $1,500 per person funeral expenses $3,000 death benefit $250 per week or 85% of lost income (whichever is less) (up to one year) $20 per day for household services (up to one year) |

As of February 2023

*Michigan drivers can select a PIP limit of $250,000, a $500,000 limit, or unlimited PIP coverage. Drivers enrolled in Medicaid may qualify for a limit of $50,000. Drivers can opt out of PIP coverage entirely if they have Medicare Parts A and B and members of their household have health insurance that covers accident-related injuries with a deductible of $6,000 or less (or Medicare Parts A and B).

Pennsylvania law requires drivers to carry at least $5,000 in medical benefits coverage, not PIP specifically

In addition to the states where PIP is mandatory, seven states and the District of Columbia require insurers to offer PIP but allow drivers to reject the coverage. Specifically, PIP is optional in Arkansas, Kentucky, Maryland, South Dakota, Texas, Virginia, and Washington.

Learn more about PIP insurance requirements by state.

Do You Need PIP Insurance?

You need PIP insurance if you live in one of the 12 states where PIP coverage is required. Even if it is not required, buying PIP insurance is a good idea because PIP can pay for accident-related medical expenses for you and any passengers in your car, while your health insurance only covers you. Additionally, PIP covers non-medical costs like childcare and lost wages.

While you may be able to collect from the at-fault driver’s bodily injury liability coverage, the claims process and potential litigation may delay payments for several months, leaving you and your passengers on the hook for your own medical expenses from the accident in the meantime.

Learn more about whether you need PIP insurance.

PIP Insurance vs. Medical Payments Coverage

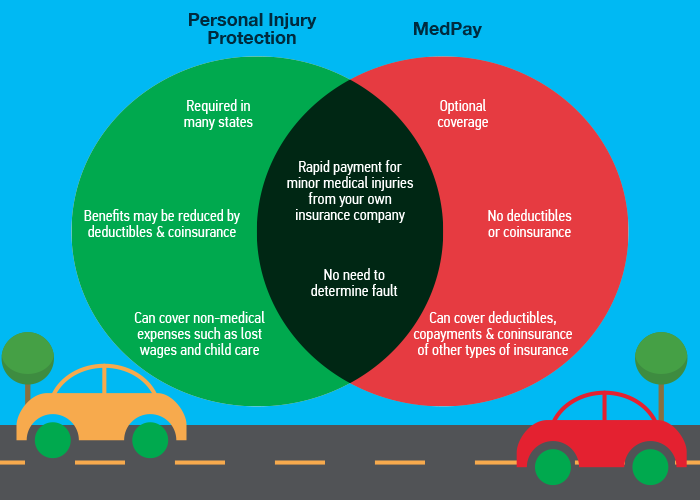

Like PIP, MedPay covers medical bills without regard to fault. However, MedPay only covers medical expenses, so it can’t help with other costs like income loss or childcare expenses.

MedPay’s biggest advantage is that it never makes the consumer pay deductibles or coinsurance for medical care, and it can pay for the deductibles, coinsurance and copays of other types of insurance – including your PIP coverage.

The chart below illustrates the similarities and differences between these two types of insurance.

Learn more about the similarities and differences between PIP and medical payments coverage.

PIP Insurance vs. Bodily Injury Liability Coverage

While PIP insurance pays for the policyholder’s own medical bills, regardless of fault, bodily injury liability coverage pays for other people’s medical expenses when the policyholder is at fault in an accident. Bodily injury liability coverage is a main component of liability auto insurance and is required in almost every state

| Category | Personal Injury Protection | Bodily Injury Liability Coverage |

|---|---|---|

| Injuries to the Policyholder | Covered | Not Covered |

| Injuries Caused by the Policyholder | Not Covered | Covered for Others |

| Medical Bills | Covered | Covered for Others |

| Funeral Expenses | Covered | Covered for Others |

| Lost Income | Covered | Covered for Others |

| Legal Fees | Covered | Covered |

| Required in Most States? | No | Yes |

| Deductible? | Yes | No |

Learn more about PIP insurance vs. bodily injury liability coverage.

Tips for Picking a Personal Injury Protection Coverage Limit

- Review your existing health insurance coverage. While health insurance may cover a range of medical expenses, it may not cover all expenses related to a car accident, such as lost wages or other non-medical expenses. Additionally, PIP insurance will cover any passengers in your car at the time of the accident, while health insurance will only cover whoever is covered by your health insurance policy. However, if your health insurance provides adequate coverage for your medical expenses, then your PIP limit does not need to be more than what is required.

- Consider your health insurance deductible. If you have a high health insurance deductible, you may be responsible for paying a significant amount of your medical expenses out of pocket before your health insurance coverage kicks in. PIP insurance can help cover these out-of-pocket costs.

- Know which type of insurance will be primary. In some states, PIP insurance may be considered primary to health insurance. This means that if you are injured in a car accident and have PIP insurance, your PIP coverage would be the first to pay for your medical expenses and your health insurance would cover expenses above your PIP limit. If your health insurance limit is low, you should consider opting for a higher PIP insurance limit.

- Check your life insurance plan. PIP insurance pays for funeral costs and survivors’ loss, which covers the loss of your income for any surviving dependents. If these things are already covered under a sufficient life insurance plan, then you could opt for a lower PIP insurance limit, as long as you do not need PIP insurance for other circumstances.

- Consider how an injury could affect your life. Major physical injuries may be more harmful to some careers than others. For instance, if your work requires physical labor, an injury may keep you from working for longer than it would with a different job. If your ability to work would be significantly hindered if you are physically injured, a high PIP insurance limit may be a smart choice. PIP covers lost wages if you are unable to work because of an accident-related injury.

Video: PIP Insurance Explained

Ask The Experts

To gain more insight about Personal Injury Protection (PIP), WalletHub posed the following questions to a panel of experts. Click on the experts below to view their bios and answers.

1. What are the benefits of having personal injury protection (PIP)?

2. When should drivers get more than the minimum amount of PIP coverage?

3. Should drivers get PIP insurance even if it is not required in their state?

4. Is PIP or MedPay better for drivers?

Ask the Experts

Professor of Business Law, Smeal College of Business, Pennsylvania State University

Read More

Ph.D., CPA, MBA, Department Chair, Accounting & Financial Management, Associate Professor of Accounting, Freeman College of Management, Bucknell University

Read More

D.Sc., Professor of Business Management, Rowland School of Business, Point Park University

Read More

Professor, College of Business and Economics, University of Wisconsin-River Falls

Read More

Ed.D., Professor, Nutrition and Food Science Program, Middle Tennessee State University

Read More

CFP®, Adjunct Faculty, Florida Southern College, Barney Barnett School of Business and Free Enterprise

Read More

WalletHub experts are widely quoted. Contact our media team to schedule an interview.