A credit report is a record of how responsible you've been as a borrower over the years. It contains information reported to the credit bureaus by creditors and lenders, including the types of accounts you have, your monthly account balances, credit limits, and payment history.

Financial institutions use the information in your credit report to determine how risky lending to you would be and to decide what interest rates to give you. Landlords and employers may also look at your credit report to decide whether to rent you an apartment or hire you for a particular position.

Continue reading to learn more about what’s in a credit report, why it’s important, how to check your own report, and who else can see it.

What Is Included in a Credit Report?

A credit report includes details such as your personally identifying information, your payment history for many types of bills (including credit cards, car loans, mortgages, and student loans), and recent credit inquiries. It can also include certain types of public records. Below, you can get a breakdown of what a credit report shows.

Personal information: Your name, date of birth and Social Security number will be listed, along with current and past addresses and employers.

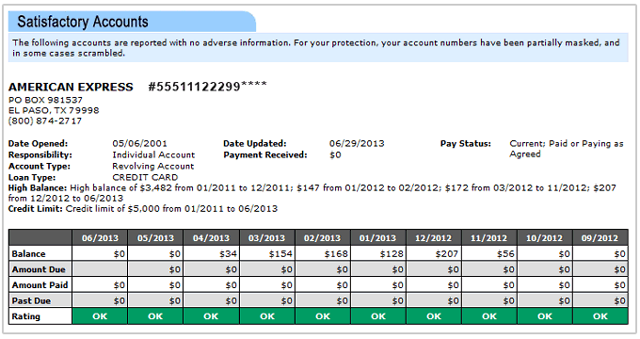

Credit history: Account information such as the dates your accounts were opened and closed, credit limits, account balances, payment history, and the name of the creditor will be listed.

Credit inquiries: This is a record of who has viewed your credit report.

Certain public records: Most public records are not included in your credit report. However, bankruptcy filings and foreclosures can be listed.

Consumer statement: This is a statement from you that explains any derogatory information contained in your file.

Learn more about what is included in a credit report.

What Are the Major Credit Reports?

The major credit reports are from Experian, Equifax, and TransUnion. These companies track credit information for banks as well as other lenders, employers, and various decision makers across industries and are known as “credit bureaus,” or “credit agencies.” You can find a bit of information about each below.

- Equifax is the oldest of the three major credit bureaus. The Equifax customer service department can be reached at 1-888-378-4329. Its mailing address is: Equifax Information Services LLC / P.O. Box 740256 / Atlanta, GA 30374

- Experian is the youngest of the three major credit bureaus, and its customer service department can be reached at 855-414-6048. Its mailing address is: Experian / P.O. Box 4500 / Allen, TX 75013

- TransUnion is the smallest of the three major credit bureaus, and its customer service department can be reached at 1-800-916-8800. Its mailing address is: TransUnion Consumer Solutions / P.O. Box 2000 / Chester, PA 19016-2000

Fortunately, each major credit bureau is required by law to provide every consumer with a free copy of their credit report once a year, upon request. To learn more check out WalletHub’s guide on credit reporting agencies.

Why Is a Credit Report Important?

A credit report is important because it is used by lenders, creditors, landlords, potential employers, and more to determine how financially responsible you are. A credit report marked with late payments, collection accounts, and bankruptcies will make you seem risky to do business with.

A good credit report, on the other hand, increases your odds of getting approved for new credit cards and loans with attractive terms. This can save you a lot of money. You’re also more likely to get a job and be approved for an apartment if your credit report is in good shape.

How good your credit is depends on several factors, including:

- How often you pay your bills on time (always, sometimes, rarely, etc.)

- The length of time you’ve been using credit

- How often you apply for new credit

- How much of your available credit you are currently using

- How much total debt you have

- Whether you’ve had any collection accounts, bankruptcies, or foreclosures in the past 7-10 years

Credit report information that reflects accounts in good standing will tell lenders that you are responsible, while delinquent payments will make it harder or more costly to access credit in the future, especially if you’ve been using credit for a relatively short period of time.

Credit Report Misconceptions

Understanding your credit reports and avoiding common consumer misconceptions is extremely important. What are some examples of such misconceptions? Well, according to consumer law expert Cary Flitter, they are as follows (in no particular order):

- “That it is difficult or cumbersome to request a credit report annually. It isn’t.

- That requesting your own credit report on more than one occasion in a year will reduce your score. Requesting one’s own credit report is not supposed to affect the score at all.

- That you need some advanced degree to read/interpret them. The consumer actually gets a ‘consumer file disclosure’ which is a more simplified format of the credit report (and is supposed to reflect all of what’s in the credit report).

- That there’s nothing you can do and if you had an old overdue account, it will just haunt you. Sometimes if you submit a legitimate dispute, it’s less trouble for the lender to remove the negative than to do a proper investigation.”

Who Looks at Your Credit Report?

The Fair Credit Reporting Act (FCRA) dictates which organizations and individuals can access consumer credit reports. In general, this law limits access to creditors, government agencies, and third parties with “legitimate” business needs to whom you have granted permission. More specifically, consumer reporting agencies may provide the following entities with access to your files under certain circumstances:

- Financial Institutions: In order to evaluate applications for financial products and conduct periodic customer performance reviews.

- Insurance Companies: For policy underwriting purposes.

- Credit Monitoring Services: Whom you’ve hired to notify you of changes to your credit profile, perhaps signaling credit improvement or evidence of identity theft.

- Government Agencies: For professional licensing and law enforcement purposes. In many cases, access is limited to only biographical information (e.g., name, address, and employer).

- Child Support Agencies: State and local child support organizations may view credit data in order to determine payment capabilities.

- Landlords: To determine ability to pay as a result of a rental/lease application.

- Courts: May order credit report access if necessitated by legal proceedings.

- Businesses: A company that has a legitimate need to access your credit data as a result of a business transaction that you initiated.

- Employers: Current and prospective employers to whom you’ve given written permission in relation to hiring decisions.

It’s particularly important to understand when a credit check is warranted for employment purposes because some employers have been known to abuse the privilege. “Credit checks should only be conducted when job relevant (e.g., cashier position, accountant position, Director of Finance),” said Jill Ellingson, a professor of management at the University of Kansas.

“If individuals have fiduciary responsibilities as part of their job, then credit checks can be informative. Such checks can reveal elements of fiduciary integrity as well as highlighting the credit risk that a particular individual brings. Individuals facing financial challenges may be more prone to take questionable or illegal actions in conjunction with their access to firm funds.”

In most cases, your permission is a prerequisite for credit report access. However, it’s important to note that it’s not always explicitly obvious when you are granting an organization permission to view your credit data. For example, the terms and conditions of a credit card offer include language that authorizes the credit card company to pull your credit reports not only in conjunction with making an approval decision, but also on an ongoing basis for the length of your tenure as a customer. When you submit a credit card application, you are effectively agreeing to these stipulations whether you notice them ahead of time or not.

Why It Is Important to Limit Access to Your Credit Report

Ultimately, access to credit data is a very important aspect of personal finance that the general population must become more familiar with. “Consumers need to take their credit histories seriously and understand that credit reports can show every mistake one has made and that a poor score is costly,” says Maureen Karig, an assistant teaching professor with the University of Missouri–St. Louis’ College of Business Administration. “I would advise, while understanding one’s own credit report and score is important, understanding how to better manage one's finances is the key.”

You should also keep in mind that you can restrict unapproved access to your credit reports by opting out of preapproved credit card offers.

Why It Is Important to Limit Access to Your Credit Report

Ultimately, access to credit data is a very important aspect of personal finance that the general population must become more familiar with. “Consumers need to take their credit histories seriously and understand that credit reports can show every mistake one has made and that a poor score is costly,” says Maureen Karig, an assistant teaching professor with the University of Missouri–St. Louis’ College of Business Administration. “I would advise, while understanding one’s own credit report and score is important, understanding how to better manage one's finances is the key.”

You should also keep in mind that you can restrict unapproved access to your credit reports by opting out of preapproved credit card offers.

Which Credit Report Do Lenders Use?

The vast majority of lenders get their information from one or more of the major credit bureaus (i.e., Experian, Equifax, and TransUnion), while some may also supplement that with data from alternative credit bureaus. Those that work with multiple agencies or consider numerous types of credit scores either average the data or use median figures.

There is little known about the particular credit bureau(s) from which each lender gets its information. That's not surprising, however, considering how tight-lipped banks tend to be about their underwriting procedures. Ultimately, the answer is that each lender has its own policy.

How to Get Your Credit Report for Free

You can get your TransUnion credit report by signing up for a free WalletHub account. Your credit report is updated daily on WalletHub, so you’ll always have the most up-to-date information. You can also get your credit report directly from all three credit bureaus or at AnnualCreditReport.com. At AnnualCreditReport.com, you can get your credit reports for free every week.

Learn more about how to get your credit score for free.

WalletHub experts are widely quoted. Contact our media team to schedule an interview.