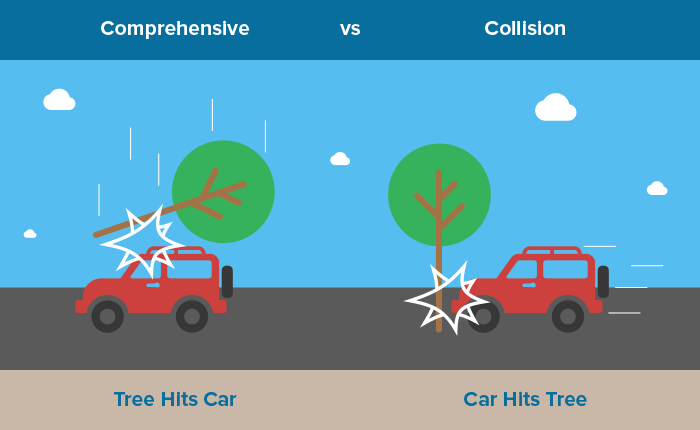

Collision insurance helps pay for damage to your vehicle after crashing into another car or object, while comprehensive insurance is a separate type of coverage that protects your car from things like falling objects, theft, and vandalism. So, the difference between comprehensive and collision is what type of damage each covers. Collision and comprehensive insurance are often combined to protect a vehicle against most forms of damage, as part of full coverage car insurance.

Key Things to Know About Comprehensive and Collision Insurance

- Comprehensive insurance covers damage to your car caused by something other than a collision, such as a fire, natural disaster, falling object or vandalism.

- Collision insurance covers repairs to your own car when you hit another vehicle, an object like a tree or fence, or a road hazard like a guardrail.

- Neither comprehensive nor collision insurance covers damage to someone else’s vehicle.

- The cost of comprehensive and collision insurance is determined largely by the value of your car.

- Comprehensive and collision may need to be purchased together, though some companies offer comprehensive-only policies for vehicles that are in storage and not actively being driven.

What Do Comprehensive and Collision Insurance Cover?

| Cause of Damage | Comprehensive | Collision |

|---|---|---|

| Theft | Covered | Not Covered |

| Falling objects | Covered | Not Covered |

| Fire | Covered | Not Covered |

| Natural disaster | Covered | Not Covered |

| Animals | Covered | Not Covered |

| Vandalism | Covered | Not Covered |

| Collision with another vehicle | Not Covered | Covered |

| Collision with a stationary object | Not Covered | Covered |

| Single-car accident | Not Covered | Covered |

Collision and comprehensive insurance will only cover damage to your own vehicle, not damage to other people’s vehicles or property such as their home or fence. Additionally, collision and comprehensive do not cover medical expenses of any kind.

In an accident, the at-fault driver’s liability insurance covers the victim’s injuries and property damage. The at-fault driver must use their own health insurance, personal injury protection, or MedPay to cover their own medical expenses.

In order to get a better handle on what comprehensive and collision insurance cover, let’s consider two examples:

Scenario 1 - Comprehensive Coverage

Imagine you are driving along a rural road, and you see a deer warning sign. Sure enough, a deer darts out and hits your car.

Because the collision was not caused by a driver’s action, the damage to your car will be covered by a comprehensive policy.

Scenario 2 - Collision Coverage

Now, picture that same road and that same deer, only this time the deer escapes and instead causes an accident between two cars.

In this example, the car in front of you slams on its brakes to avoid the deer, but you are following too closely to stop in time, and you rear-end the other car. Collision coverage will likely pay to repair your car in this case.

Comprehensive vs. Collision Insurance: Similarities and Differences

Although drivers will make collision and comprehensive insurance claims under different circumstances, these two types of coverage are otherwise very similar. Let’s review the main similarities and differences.

Similarities Between Comprehensive and Collision Insurance

- Both comprehensive and collision insurance cover damage to your own vehicle. Unlike most types of insurance that are required by state law, collision and comprehensive can be used if your own vehicle is damaged.

- You don’t have to choose a coverage limit. The coverage limit is the actual cash value of your car.

- Comprehensive and collision insurance both require you to pay a deductible when you file a claim. You’ll select your deductible amount when you purchase your policy.

- Insurance companies typically offer comprehensive and collision packaged together. Some insurers require the purchase of comprehensive coverage before you can buy collision coverage, but not vice versa.

- Both are optional under state laws. If your car is financed or leased, however, your lender or leasing company will likely require you to purchase both types of coverage.

Differences Between Comprehensive and Collision Insurance

- Collision and comprehensive insurance cover different situations. Collision insurance covers drivers when they are in an accident with another vehicle or they hit an object. On the other hand, comprehensive insurance applies when a car is damaged by something other than a collision.

- Collision coverage is more expensive than comprehensive coverage. Collision insurance premiums are up to three times higher than comprehensive premiums.

Comprehensive vs. Collision: How Much They Cost

A major factor in the price of both comprehensive and collision coverage is the value of your car. The more your insurer might have to pay if your car is totaled, the more risk the insurer has and, therefore, the more you will pay in premiums.

The table below breaks down examples of auto insurance premiums for three different cars. The sample policies include liability insurance, comprehensive coverage and collision coverage.

Monthly Cost of Comprehensive Coverage vs. Collision Coverage

| Vehicle Value | Comprehensive | Collision |

|---|---|---|

| $13,400 | $9.60 | $31.40 |

| $23,700 | $15.60 | $45.40 |

| $31,290 | $21.00 | $72.20 |

Note: Premium figures assume comprehensive and collision coverage each with a $1,000 deductible, a bodily injury liability policy with a limit of $50,000 per injured person and a maximum payout of $100,000 per accident, as well as a property damage liability limit of $50,000.

Factors to Consider Before Buying Comprehensive and Collision Insurance

Your financial situation

If your car is suddenly damaged or totaled, could you afford to repair or replace it? If the answer is no, you should get collision and comprehensive coverage to avoid a financial disaster.

The value of your car

A good rule of thumb is that if the cost of comprehensive or collision coverage exceeds 10% of your vehicle’s value, you should consider dropping them. After all, if your car is totaled, collision and comprehensive coverage will only pay you the amount that it’s worth at the time of the damage.

Your driving habits

Do you have a long commute every day, or do you only use your car occasionally? The more you drive, the higher risk you are for being in an accident, which means you’re more likely to need collision insurance.

Where you live

Even if you don’t drive very often, you should consider buying comprehensive coverage if your area has a high crime rate or is prone to natural disasters such as wildfires and floods.

Cheapest Comprehensive and Collision Insurance Companies

Learn more about the cheapest comprehensive and collision insurance companies.

Video: Comprehensive vs. Collision Car Insurance

Ask the Experts

To gain more insight about comprehensive and collision insurance, WalletHub posed the following questions to a panel of experts. Click on the experts below to view their bios and answers.

1. Do you think comprehensive and collision insurance should be mandatory?

2. Do you think the average driver knows the difference between comprehensive and collision insurance?

3. Why do insurance companies bundle comprehensive and collision coverage, rather than letting you pick one or the other?

Ask the Experts

MSFS, CFP®, ChFC®, AFC®, RICP®, WMCP®, Director of Curriculum; Assistant Professor, O. Alfred Granum Chair in Practice Management & Charles J. Zimmerman Chair in Life Insurance Education - The American College of Financial Services

Read More

Ph.D., Assistant Professor of Instruction, Department of Finance & Real Estate, College of Business - University of Texas at Arlington

Read More

Lecturer, John Maze Stewart Department of Finance and Quantitative Methods - University of Kentucky

Read More

LLM, JD, MEd, Attorney at Law, (Illinois, California), Clinical Professor of Business Law & Ethics (University of San Diego, Retired)

Read More

Ph.D., Clinical Professor, Finance, Department of Finance - University of Illinois at Chicago, Business School

Read More

Ph.D., Professor, Department of Finance, Insurance and Law, College of Business - Illinois State University

Read More

WalletHub experts are widely quoted. Contact our media team to schedule an interview.