Credit card companies are the banks and credit unions that issue credit cards to consumers and small business owners. Credit card companies also service cardholders’ accounts by billing for purchases, accepting payments, distributing rewards and more.

The four major card networks – Visa, Mastercard, American Express and Discover – are credit card companies, too, though Visa and Mastercard don’t issue their own cards. They handle things like payment processing and high-level benefits.

Top 10 Credit Card Companies

- Chase

- American Express

- Citi

- Capital One

- Bank of America

- Discover

- U.S. Bank

- Wells Fargo

- Barclays

- Synchrony Bank

See the Best Credit Cards of 2025

Credit Card Issuers

Credit cards are usually issued by banks and credit unions. They give these financial institutions a fairly steady source of revenue from account fees, interest charges and payment processing fees charged to merchants. The transactional nature of credit cards also gives issuers a chance to establish relationships with consumers. That allows them to upsell cardholders to other products and services.

Credit card issuers handle things like:

- Processing applications

- Mailing out cards

- Setting interest rates and fees

- Setting credit limits

- Providing rewards

- Providing some benefits

- Customer service

- Reporting account history to the credit bureaus

The heart of a credit card company is its underwriting team. Underwriters evaluate applicants’ credit history, income and debt load to determine whether their risk and profit potential qualify them to get a credit card. The terms a credit card company offers to customers and its ability to turn a profit depend on how sophisticated its underwriting is and how well it can avoid uncollectible debt. Basically, if a credit card company approves people who pay their bills, it can better afford to provide rewards and benefits in return.

The following chart will show you which companies are the biggest players in the credit card game. You can also check out WalletHub’s Statistics Center for a more detailed look at the credit card landscape.

Market Share by Credit Card Issuer

Other Credit Card Issuers

Although the biggest credit card issuers are all national banks, credit unions and regional banks issue tons of credit cards as well.

Some of the best credit unions to get a credit card from include Navy Federal Credit Union, PenFed Credit Union, Alliant Credit Union and General Electric Credit Union. Some advantages that credit unions provide over big banks include a more personalized relationship with their customers and fairly low interest rate caps under federal and state law.

Offers from regional banks are also worth exploring. You can use WalletHub’s bank comparison tool to see the banks that are available in your area, the products they offer and their user reviews.

Credit Card Networks

The four major credit card networks are Mastercard, Visa, American Express and Discover. Mastercard and Visa once held a significant lead in terms of acceptance, but American Express and Discover have made considerable progress over time.

Things that credit card networks handle include:

- The worldwide processing of credit card transactions, acting as a gateway between consumers, merchants and credit card companies

- Setting terms for credit card transactions (e.g., interchange fee & fraud liability)

- Providing certain high-level benefits, such as travel insurance, rental car insurance, purchase protection and extended warranties on purchases

While the major credit card networks all perform a similar function, there are some important differences between them. As you can see from the graphic below, there is a clear hierarchy based on the purchase volume that each handles.

Market Share by Card Network

Check out WalletHub’s Statistics Center for more card network market share information.

Visa, Mastercard, Discover and American Express also differ in terms of where they can be used – both in the U.S. and abroad. The benefits they provide have earned varying grades in WalletHub’s research, too.

Major Credit Card Networks Compared

| Card Network | VISA | MASTERCARD | DISCOVER | AMERICAN EXPRESS |

|---|---|---|---|---|

| U.S. Acceptance | 10.7 million merchants | 10.7 million merchants | 10.64 million merchants | 10.6 million merchants |

| International Acceptance | 200+ countries | 210+ countries | 200+ countries | 198+ countries |

| Fraud Protection | Good | Good | Excellent | Excellent |

| Contact | 1-800-847-2911 | 1-800-307-7309 | 1-800-347-2683 | 1-800-528-4800 |

It’s also important to reiterate that American Express and Discover aren’t just card networks. They’re credit card issuers, too. So if you have a problem with your Discover bill, for example, you can contact Discover directly. But if you have a problem with your Visa bill, you’ll have to contact the card’s issuer – Capital One, for instance.

Credit Card Issuer vs. Network

A credit card issuer is the bank or credit union that issues a credit card, sets its terms and features, and services the account. Examples include Bank of America, Capital One, Citi, Wells Fargo and more.

Credit card networks play a different role. They dictate where credit cards can be used, facilitate payment processing at the point of sale and administer secondary credit card benefits, such as rental car insurance, travel insurance and extended warranties.

The four major card networks are Visa, Mastercard, American Express and Discover. The tricky part is that two of the world’s largest card networks – American Express and Discover – also issue credit cards.

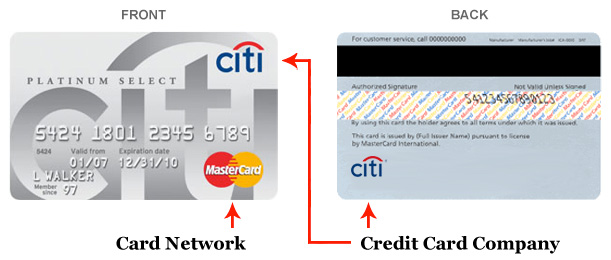

If you aren’t sure which company issued your credit card, check the plastic. The issuer’s name typically appears in big fancy lettering on the front of the card, in the top right or left corner. You'll also find it on the back, at the bottom of the card. Below, you can see an illustration.

This won’t necessarily be the case with store credit cards or co-branded cards, however. The name of the retailer or organization they’re associated with tends to be displayed most prominently. The issuer’s name will be on the card somewhere, but it may be more difficult to locate than with a normal credit card.

In addition, co-branded cards will bear the logo of the credit card they’re associated with and can be used anywhere that network is accepted. On the other hand, store credit cards are not on a credit card network since they can only be used at the partnered merchant, so they will not have a network logo.

It’s important to understand which credit card company issued your card as well as which network it’s on. The former will tell you whom to call if you have a question about your account. And the latter will tell you where you can use your card, plus whether you get perks like:

- $0 fraud liability

- Rental car insurance

- Travel insurance

- Extended warranties

- Purchase protection

- Return protection

- Price protection

It’s also worth noting that while credit card networks provide many benefits, the credit card’s issuer ultimately decides which benefits your card will actually include.

Major Credit Card Companies

Below, you can see a list of popular credit card companies based on the number of cards they have in circulation in the U.S.:

- American Express: 59.2M

- Bank of America: 57.3M

- Barclays: 26.7M

- Capital One: 115.6M

- Chase: 180.9M

- Citibank: 86.7M

- Discover: 66.3M

- Mastercard: 266.3M

- Navy Federal Credit Union: 6.7M

- Pentagon Federal Credit Union: 1.5M

- PNC: 6.6M

- USAA: 6.5M

- U.S. Bank: 24.4M

- Visa: 312.2M

- Wells Fargo: 22.2M

Major Credit Cards

Now that you’re familiar with the credit card industry’s biggest players, it’s time to get to know some of their most popular products. Below, you can find a comparison of some major credit cards that are definitely worth considering.

This content is not provided or commissioned by any issuer. Opinions expressed here are the author’s alone, not those of an issuer, and have not been reviewed, approved or otherwise endorsed by an issuer. WalletHub independently collected information for some of the cards on this page.

| Category | Card Name | Annual Fee | Min. Credit Required | Editor’s Rating |

| Travel Rewards | Chase Sapphire Preferred® Card | $95 | Good | 5/5 |

| Cash Back | Wells Fargo Active Cash® Card | $0 | Good | 4.9/5 |

| Initial Bonus | Chase Sapphire Preferred® Card | $95 | Good | 5/5 |

| 0% Intro Purchases | U.S. Bank Shield™ Visa® Card | $0 | Good | 4.9/5 |

| Balance Transfer | Citi Simplicity® Card | $0 | Good | 3.7/5 |

| Fair Credit | Capital One QuicksilverOne Cash Rewards Credit Card | $39 | Limited History | 4.7/5 |

| Limited Credit | Petal® 2 Visa® Credit Card | $0 | Limited History | 5/5 |

| Bad Credit | Discover it® Secured Credit Card | $0 | Bad | 5/5 |

| College Students | Capital One Savor Student Cash Rewards Credit Card | $0 | Limited History | 4.7/5 |

| Business Owners | Capital One Spark Cash Plus | $150 | Excellent | 4.8/5 |

Overview of Major Credit Card Companies

American Express

| Contact Info: 1-800-528-4800 |

Established in 1850 in New York City, American Express now operates in more than 200 countries. As of 2025, Amex is the second-largest credit card issuer by purchase volume, and it’s one of the largest by cards in circulation as well.

American Express also is known for offering charge cards and for targeting its products to high-income individuals with strong credit scores. As a result, Amex is a great source of lucrative rewards credit cards but is not heavily involved in the credit improvement space.

- American Express Reviews: 3.9 average user rating

- Uses Deferred Interest: No

- Small Business Friendliness: 60%

- Rental Car Insurance: 88.50%

- Foreign Transaction Fee: 0% - 3%

- Extended Warranty: 95% - 99%

- Travel Insurance: 25.45% - 34.25%

- Price Protection: Not Offered

- Return Protection: 76%

- Purchase Protection: 89% - 92%

Bank of America

| Contact Info: 1-800-732-9194 |

Bank of America is one of the biggest financial institutions in the world, not to mention one of the largest companies overall. Headquartered in Charlotte, NC, the banking behemoth now has roughly 213,000 full-time employees and does $96+ billion in annual revenue. In addition to its credit card operation, Bank of America offers deposit accounts, investment vehicles, and financial management services to consumers. The company also has corporate and investment banking divisions.

Bank of America was founded in San Francisco in 1904. But it actually started out as Bank of Italy, in an attempt to serve the needs of America’s growing immigrant population. It was renamed in 1930, and the company’s continued expansion eventually led to the first ever general-use credit card, known as the BankAmericard. That product later became the basis for Visa.

Bank of America has since made numerous acquisitions. This includes its crucial all-stock purchase of Merrill Lynch at the Federal Reserve’s urging during the Great Recession. Like many other large financial institutions, BofA has also come under fire for various alleged wrongdoing during the downturn and beyond. But the credit card market is a much safer place these days. And Bank of America has actually been a leader in bringing consumer credit card protections to business credit cards.

- Bank of America Reviews: 3.7 average user rating

- Uses Deferred Interest: No

- Small Business Friendliness: 100%

- Rental Car Insurance: 78.5% - 85%

- Foreign Transaction Fee: 0% - 3%

- Extended Warranty: 61% - 80%

- Travel Insurance: 23.95% - 87.98%

- Price Protection: Not Offered

- Return Protection: 76%

- Purchase Protection: 76.5%

Barclays

| Contact Info: 1- 302-622-8990 |

Barclays launched the first UK credit card program in 1966, and it moved into the U.S. market in 2004, with the purchase of Juniper Financial Corporation. The company’s U.S. credit card division operated under the brand name “Barclaycard US” until 2008, when it took its parent’s name.

Barclays is best known for its travel rewards credit cards as well as its suite of co-branded credit cards, issued in partnership with popular brands such as U.S. Airways, L.L. Bean, and the National Football League. Barclays credit cards typically require good or excellent credit for approval.

- Barclays Reviews : 3.7/5 average user rating

- Uses Deferred Interest: No

- Small Business Friendliness: 85%

- Foreign Transaction Fee: 0% - 3%

Capital One

Capital One is the 3rd largest U.S. credit card company in terms of purchase volume. The company was established in 1995 and is based in McLean, VA. It has around 250 branch locations and more than 50 “Capital One Cafes” in the U.S. In addition to credit cards, Capital One is known for everyday banking products, personal loans and auto loans.

Capital One has made a name for itself in the credit card market with offers for people of all credit levels, simple rewards programs and reasonable fees. The Capital One Venture Rewards Credit Card has long been regarded as one of the best travel rewards cards on the market. The Capital One QuicksilverOne Cash Rewards Credit Card is one of the best everyday cash rewards cards. And the Spark Cash family of cards are among the top offers available to small business owners.

Capital One also was the first credit card issuer to remove foreign transaction fees from all of its cards.

- Capital One Reviews: 3.7 average user rating

- Uses Deferred Interest: No

- Small Business Friendliness: 60%

- Rental Car Insurance: 86% - 88.5%

- Foreign Transaction Fee: None

- Extended Warranty: 78% - 87%

- Travel Insurance: 62.5% - 82.35%

- Price Protection: 73.5%

- Return Protection: 80.5%

- Purchase Protection: 70% - 85%

Chase

| Contact Info: 1-800-432-3117 |

Chase credit cards are issued by JPMorgan Chase & Co. – the largest bank in the U.S. by total deposits. Chase Bank was an independent entity – Chase Manhattan Bank – until its 2000 merger with commercial and investment banking giant JPMorgan. JP Morgan Chase now employs more than 300,000 people and does business in 100+ countries.

Chase is known for offering a wide range of credit cards, from its popular Freedom cash back cards to its lucrative Sapphire travel cards, which have some of the biggest initial bonuses on the market. Chase also offers co-branded cards in partnership with the likes of British Airways, United Airlines and Southwest Airlines. As you might expect based on the types of offers in its portfolio, Chase’s credit cards are mainly for people with above-average credit.

- Chase Reviews: 3.8 average user rating

- Uses Deferred Interest: No

- Small Business Friendliness: 60%

- Rental Car Insurance: 91% - 93.5%

- Foreign Transaction Fee: 0% - 3%

- Extended Warranty: 85% - 87%

- Travel Insurance: 13.5% - 92.9%

- Price Protection: Not Offered

- Return Protection: 86.5%

- Purchase Protection: 87.5% - 93.5%

Citibank

| Contact Info: 1-800-347-4934* |

Citibank is the consumer banking division of the financial services company Citigroup. It was founded in 1812 as the City Bank of New York. As of 2025, it is the second largest U.S. bank by purchase volume.

Citibank targets the majority of its credit card offers to people with above-average credit standing. The company is known for offering cards with extended 0% introductory periods as well as a broad selection of rewards. Citi has two well-known rewards programs – ThankYou and Double Cash – in addition to co-branded partnerships with American Airlines and Expedia.

- Citibank Reviews: 3.6 average user rating

- Uses Deferred Interest: Sometimes

- Small Business Friendliness: 60%

- Rental Car Insurance: 86%

- Foreign Transaction Fee: 0% - 3%

- Extended Warranty: 91%

- Travel Insurance: 34.25%

- Price Protection: Not Offered

- Return Protection: Not Offered

- Purchase Protection: Not Offered

Discover

| Contact Info: 1-800-347-2683

|

Discover began as a division of the financial services company Dean Witter and was designed to issue the company’s Sears credit card. Discover Financial Services became an independent company in 2007.

Discover is known for offering cash rewards and was, in fact, the pioneer of the first cash back program. But the company now has a wide range of credit card offers, even though many of them have very similar names. Several different cards use the “Discover it” brand, offering low intro APRs, various types of rewards, and special perks such as a first-year rewards match. Discover also issues co-branded cards in partnership with a number of retailers and major universities. None of Discover’s credit cards charge foreign transaction fees.

- Discover Reviews: 4.0/5 average user rating

- Uses Deferred Interest: No

- Small Business Friendliness: 85%

- Rental Car Insurance: Not Offered

- Foreign Transaction Fee: None

- Extended Warranty: Not Offered

- Travel Insurance: Not Offered

- Price Protection: Not Offered

- Return Protection: Not Offered

- Purchase Protection: Not Offered

PNC

| Contact Info: 1-888-762-2265 |

PNC Financial Services Inc. – more commonly known by its ticker symbol, PNC – is the seventh-largest U.S. bank in terms of total assets and deposits as well as a prominent credit card issuer. As a regional player with a footprint in 27 states as well as the District of Columbia, the PNC brand is strongest east of the Mississippi River where the vast majority of its retail bank branches are located. PNC has particularly strong ties to Pittsburgh, the home of its corporate headquarters. In fact, PNC Park is home to the city’s professional baseball team – the Pirates.

PNC is a full-service credit card issuer with offers ranging from secured credit cards for people with bad credit to rewards cards for people with stellar credit. Interestingly, the bank offers more credit cards for small business use than it does for personal use.

- PNC Reviews: 3.6 average user rating

- Uses Deferred Interest: No

- Small Business Friendliness: 100%

- Foreign Transaction Fee: 0% - 3%

USAA

| Contact Info: 1-800-531-8722 |

USAA – the United States Automobile Association – is a full-service financial institution that offers credit cards, banking products, insurance, and investment services to current and former members of the military, employees of select federal agencies, and their families. USAA offers credit cards for people of all credit levels, from secured cards for people with bad credit or no credit history to rewards cards for people with good or excellent credit.

- USAA Bank Reviews: 3.5 average user rating

- Uses Deferred Interest: No

- Small Business Friendliness: N/A

- Foreign Transaction Fee: None

- Extended Warranty: 85%

U.S. Bank

| Contact Info: 1-888-852-5786 |

U.S. Bank is the country’s fifth-biggest bank in terms of total assets and the seventh-largest credit card issuer based on purchase volume. When it comes to credit cards, U.S. Bank is known for rewards. The company offers co-branded credit cards with corporate partners like Kroger and Harley-Davidson. U.S. Bank-branded rewards cards are also available.

It’s interesting to note that while many of the major issuers known for their rewards target offers almost exclusively to people with above-average credit standing, U.S. Bank extends credit to people across the credit spectrum.

- U.S. Bank Reviews: 3.9/5 average user rating

- Uses Deferred Interest: No

- Small Business Friendliness: 45%

- Rental Car Insurance: 78% - 88.5%

- Foreign Transaction Fee: 0% - 3%

- Extended Warranty: 73% - 82%

- Travel Insurance: 16.5% - 67%

- Price Protection: Not Offered

- Return Protection: 80.5%

- Purchase Protection: 70%-91%

Wells Fargo

| Contact Info: 1-800-432-3117 |

Wells Fargo was founded in 1852 to meet the banking needs of pioneers during the California Gold Rush. That’s not the only fun fact about the bank, either. Wells Fargo actually holds the first ever banking charter issued by the United States government, assuming it through the company’s 2008 acquisition of Wachovia. As of 2025, Wells Fargo is the third-largest bank in the U.S. in terms of total assets and total deposits.

Wells Fargo’s reach into the credit card market isn’t quite as extensive as its presence in the everyday banking space, however. It is the eighth-largest credit card issuer in the U.S based on purchase volume. Wells Fargo focuses on rewards credit cards and 0% APR credit cards for people with good or excellent credit, and it has some business credit card offers as well.

- Wells Fargo Reviews: 3.7 average user rating

- Uses Deferred Interest: No

- Small Business Friendliness: 70%

- Rental Car Insurance: 88.5% - 90%

- Foreign Transaction Fee: 0% - 3%

- Extended Warranty: Not Offered

- Travel Insurance: 61.15% - 87.75%

- Price Protection: Not Offered

- Return Protection: Not Offered

- Purchase Protection: Not Offered

Bottom Line

There are a lot of credit card companies out there, and finding the best one can be pretty daunting since there are so many factors to consider. That’s why it’s helpful to look at reviews on sites like WalletHub to see what other people’s experiences have been like.

At the issuer level, the most important thing you should worry about is how good the bank’s or credit union’s customer service is. At the network-level, you should consider where the card will be accepted, especially if you travel a lot.

For other terms, like rates, fees, rewards, credit limits, and more, it’s better to look at individual cards, since they differ greatly even within an individual issuer’s offerings. If you need more help deciding which card is best for your needs, you can use WalletHub’s free credit card comparison tool to see how different cards stack up against each other or check out our picks for the best credit cards overall. If you want personalized credit card recommendations, you can sign up for a free WalletHub account.

WalletHub experts are widely quoted. Contact our media team to schedule an interview.